2Q25 Earing, Position and Performance Updates

Exit $TRIP, $SOC; Trimmed $C, $DB, Add $SHG $FFIC; 2Q25 ER review $SEG, $GLNG, $DLTR

TL; DR:

Exited TRIP and SOC

On Banking, trimmed C, DB, added SHG, initiated FFIC

UTH Portfolio Performance (UTH 39.5% vs SPY 17.4%)

2Q25 Earnings Highlights: SEG, DLTR, GLNG (behind the paywall)

Position Change

Exit TRIP: a moderate 20% gain since its first feature in Jan 2025, exited after 2Q25 earnings, and shared my thoughts on the Substack Chat:

Exit SOC: a ~30% gain since June 2025 write-up. Exited after the July court room win, and shared my thoughts. Looking back, I had lucky exit timing, as the stock has since given back all its gains, with the market nervous about the recent AB 1448 bill passing through the CA senate. IMO, the issue with Sable isn't any particular bill, but a continuous, organized effort to deter Sable, at all costs, for an ideology-driven belief. If one wants to hold it as a long term investment, i think you must have peace with that.

Trimmed C, DB, Added SHG, Initiated: FFIC: At the high level, GSIBs have outperformed regional and community banks since the “2023 Banking Crisis”, while GSIBs (e.g. JPM C DB) benefit from diversified revenue sources, robust capital buffer and strong name recognition, its vast outperformance against smaller banks, in my opinion, is overdone.

And I find small banks are attractive. Thus, I trimmed my C DB positions and initiated a position in FFIC, a NY-based community bank. For more details, you can find my banking position updates from August.

UTH Portfolio Performance

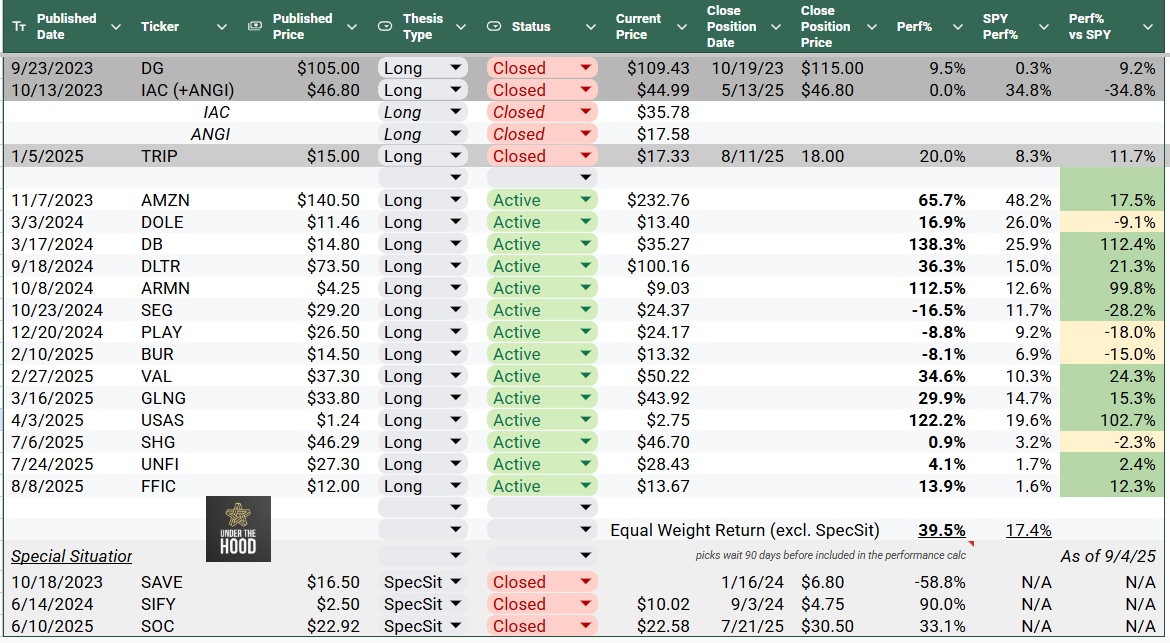

The table captures the performance (as of 9/4/2025) of all UTH-published ideas since inception in September 2023. 14 active long ideas.

All closed positions are marked with the close date and their lifetime performance.

Among regular long ideas, top 3 performers are DB USAS and ARMN, and 3 worst under performers are SEG PLAY BUR.

DB is the best performer at 138% since 3/17/2024, and SEG is the worst at -17%.

Equal weight ROIC (up to 9/4/2025) is 39.5% vs S&P500’s 17.4% *.

(*) Dividends are excluded for both the UTH and S&P 500. The performance calculation excludes newly published ideas (less than 3 months old).

2Q25 ER Updates

Seaport Entertainment Group SEG 0.00%↑ :

Keep reading with a 7-day free trial

Subscribe to Under The Hood to keep reading this post and get 7 days of free access to the full post archives.