A ‘Tired’ Sum-of-the-Parts (SOTP) Thesis

Judging by Sum-of-the-Parts, InterActiveCorp IAC 0.00%↑ , the incubator to many iconic e-commerce/marketplace platforms, including Expedia and Match Group, is so cheap that its 30% equity ownership of Turo, slated for IPO and dubbed as Airbnb for cars, is for free.

“I rarely get free lunch from SOTP meal”, one might scream (painfully).

I agree that “it is one thing to find value in SOTP, it is entirely different to extract value from it”.

However, IAC’s exemplified past track record, and key decision makers’ aligned interests with shareholders as I laid out below, offer some comfort in saying “This time might be different”.

Summary

In this research, you will find out IAC’s liquid assets (i.e. cash, and equity ownership in ANGI 0.00%↑ and MGM 0.00%↑ equates to the price you pay for the entire IAC empire (as of 10/12/2023)

With that, you are left with 2 crown jewel assets (Turo and DotDash Meredith) for free and more.

Turo has a potential catalyst (pending IPO, initially filed in Jan 2022), and I will showcase that its fundamental is worth the hype more like Airbnb ABNB 0.00%↑ than names like VinFast VFS 0.00%↑

DotDash Meredith, on the other hand, is enduring both macro and self-inflicted headwinds. However, it holds an intriguing upside if its turnaround story is realized as some early turnaround signs emerged in 2Q, and the management team continues to work on it.

IAC Story

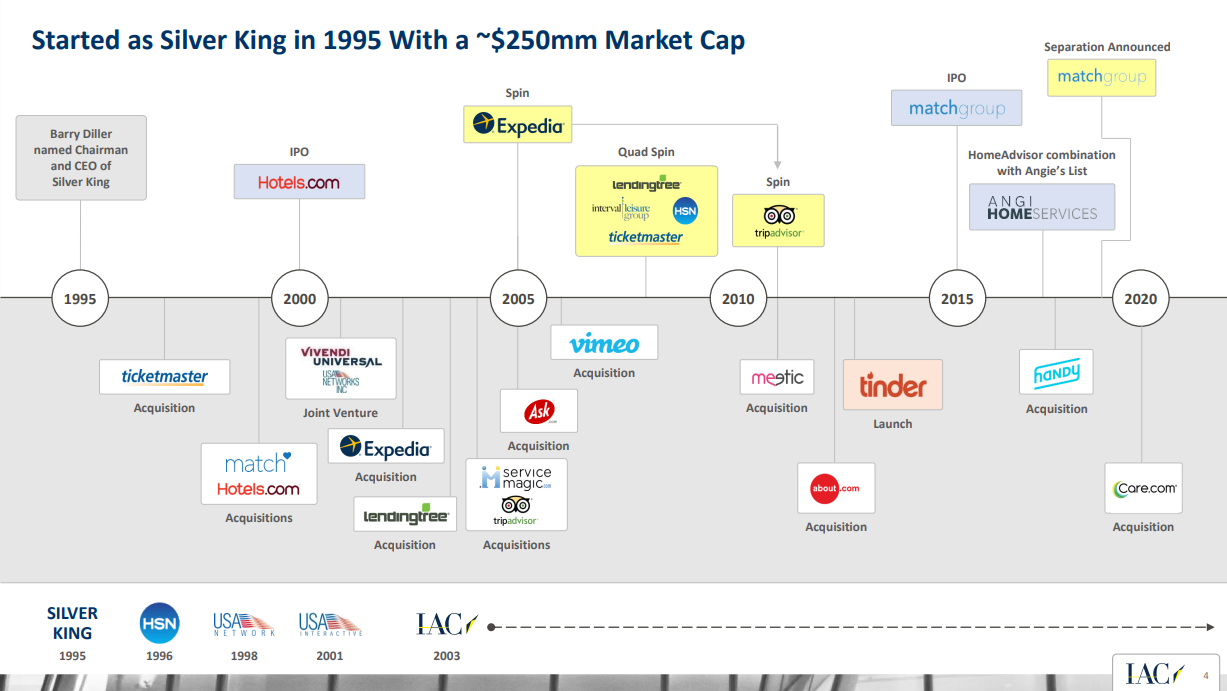

For these preferred visuals, this timeline (from its Feb 2020 ppt) is a good illustration of IAC’s storied past. (need to update with Vimeo spin-off and Meredith acqusition since)

IAC acquires companies (mostly e-commerce marketplace), develops, spins off (often via IPO), and distributes to stockholders. Over time, a dozen companies went through IAC’s incubating pipelines and became public, creating a combined value of over $60Bn. For those interested in the details, you can read its history from its latest 10k, first page.

One can’t tell an IAC story without mentioning Barry Diller.

Since acquiring control of Silver King (precursor to IAC), Barry Diller has been the heart and soul of IAC for nearly 30 years. Instead of boring readers with his well-known deal-making skills or superior vision, I find in this acquired podcast, that Dara Khosrowshahi (Uber CEO, previously Expedia CEO) a long-time Mr. Diller lieutenant shared a short story that underscored what a legendary figure Diller is.

Capital Structure and Ownership

85.8Mn shares (80Mn common, 5.8Mn Class B common), currently at $47/share (10/12/2023), $4BN market cap.

No corporate-level debt, $2Bn debts at business unit level:

DotDash Meredith: $1.5B

$0.3B SOFR+2.25% due EoY26

$1.2B, SOFR+4%, due EoY28 *

Angi: $0.5B

3.875%, due Y28

(*) $0.35B out of $1.2B fixed term at 7.92% to April 2027, via IR Swap

Mr. Diller & his family have 15% equity ownership, own all class B common, and effectively control 41.4% voting rights. Joey Levin (CEO) owns 5.4% of the company.

They own 1/5 of the company and almost half of the voting rights.

Sum-of-the-Parts Overview

I will categorize SOTP into 3 parts.

Part 1 is liquid assets including ANGI 0.00%↑ MGM 0.00%↑ , and IAC corporate-level net cash

Part 2 is Turo, the pending IPO.

Part 3 includes Doddash Meredith, search, care.com, and other assets.

Part I: Liquid Assets

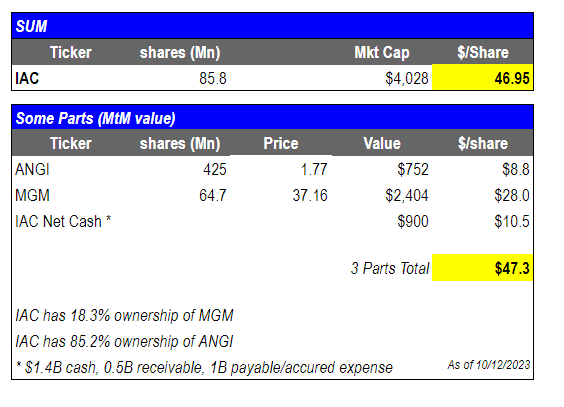

From the chart below (quoted as of 10/12/2023), the total (mark-to-market) value of ANGI, MGM, and IAC corporate level net cash is $4Bn, about $47.3/share, 101% of what IAC trades today ($46.95/share).

Most of the calculation is self-explanatory, one note as highlighted in the “Capital Structure” section, $1.5B LT debt is with Dotdash which we will cover in a section below, and $0.5B LT debt is with ANGI

Part II - Turo

Now we enter Turo - Airbnb for car rental.

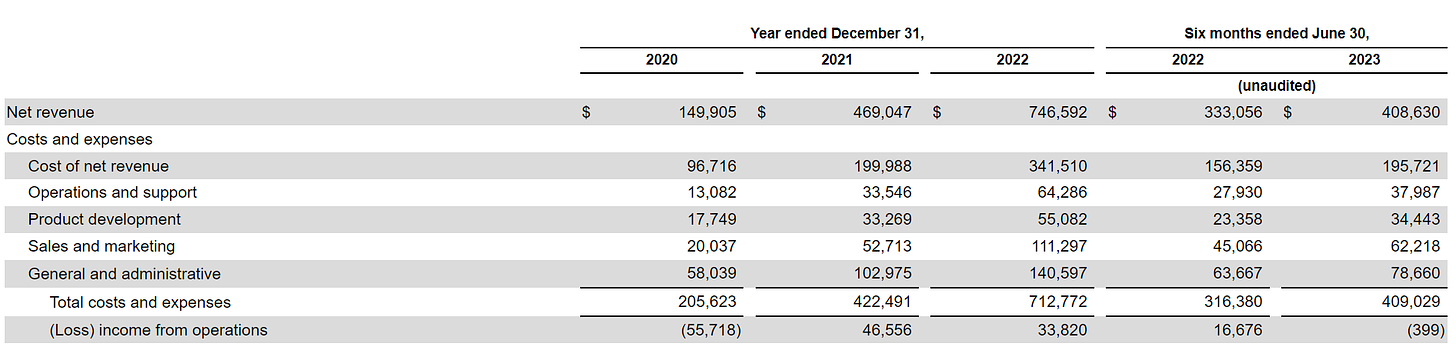

Unlike many recently hyped IPOs, Turo is not only a fast-growing but already scaled business with mouth-watering unit economics.

It has 175k active hosts, 3Mn active guests, 22Mn rental days LTM (2Q22 to 3Q23), and the daily average rental cost is ~$100, GBV $2.2B LTM (2Q22 to 2Q23), currently operates in North America, UK, France and Australia.

Its GBV grew from $351Mn in 2019 to a projected $2.45Bn in 2023, 62% CAGR in 4 years. As a frame of reference, Airbnb GBV was $8.1Bn in 2015 and $38Bn in 2019 (the year prior to IPO), 47% CAGR in 4 years.

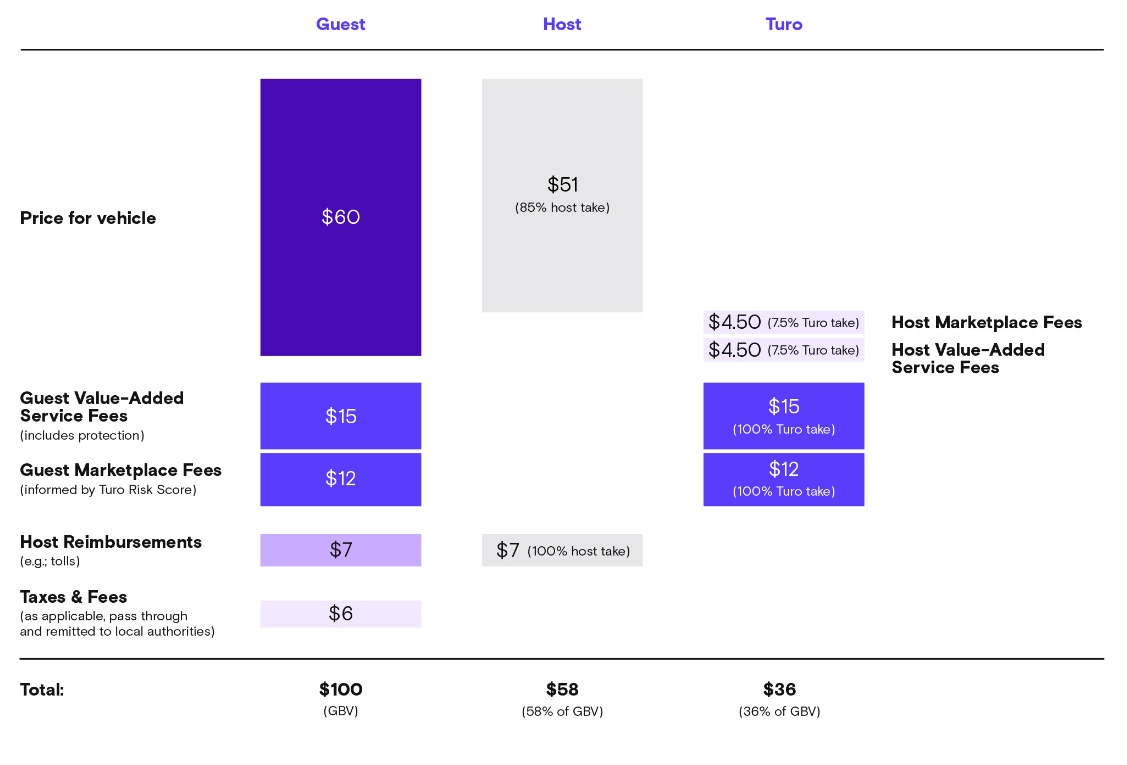

Its business model is similar to Airbnb in the sense that it charges both supply(Host), and demand (Guest), at 9% and 27%, at a combined 36% take rate, which shows the power of the marketplace platform. (Airbnb charges 3% from the Host, and ~15% from the Guest, at a combined ~18% take rate)

Unlike many high-growth businesses, Turo also has been operating profitably (most of the time) since 2021.

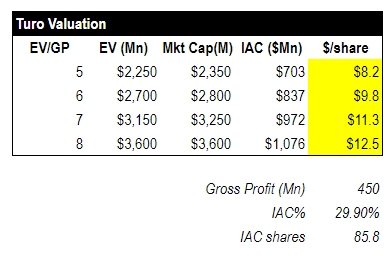

Let us take a look at valuation.

As the business is scaled enough to have a meaningful gross profit, but not yet a steady net income, I choose EV/GP and consider Airbnb its closest peer.

Currently, Airbnb trades at 8x EV/S. It has been declining from a high of 20x right after IPO and touched the bottom at 6x late last year.

Airbnb’s Gross Margin is 75-80% of revenue, thus currently trades at 10x EV/GP.

Turo’s 2023 Gross Profit (napkin math version):

$2.4B (Rev) x 36% (Take rate) x 53% (Gross Margin%) = 0.45B.

The table below shows Turo’s market cap range when valued at 5x to 8x EV/GP. I consider 6x EV/GP to be reasonably conservative, which translates to an additional $9.8 equity for each IAC share.

Note: Turo has $100Mn net cash, and IAC owns 29.9% of Turo (excluding additional warrants that could bring its ownership to 40%)

Part III: DotDash Meredith and others

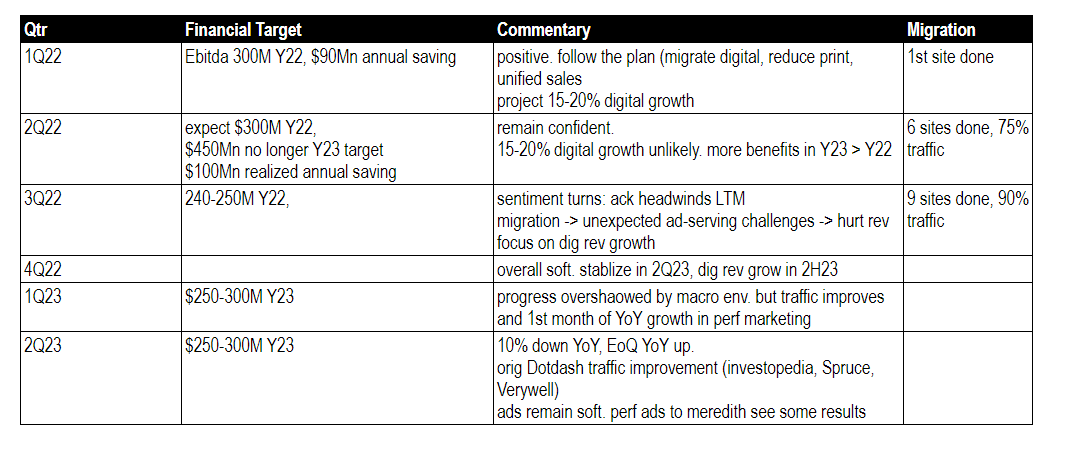

IAC acquired Meredith for $2.7Bn in 4Q21 and combined with Dotdash as one reporting segment since. 12 months prior to the acqusition, these 2 combined entities reined in $2.4Bn revenue, over $430Mn adjusted EBITDA, and projected to generate $450Mn adjusted EBITDA in 2022.

A series of missteps and macro headwinds, 6 quarters later, the combined business struggles near breakeven, and generated a mere $150Mn adjusted EBITDA in 2022 with multiple one-time charges related to acqusition.

My first conservative take is to assign a 0 value to DotDash Meredith. For those interested, I will dive into the details to assess the situation to extract potential values in the next section.

IAC’s search business makes around $80Mn/year, which by and large offset its corporate expense. I just match these two items and assign no additional value to the enterprise.

Emerging and other includes Vivian Health, care.com, etc. I assign 0, why not?

Dotdash Meredith Situation Assessment

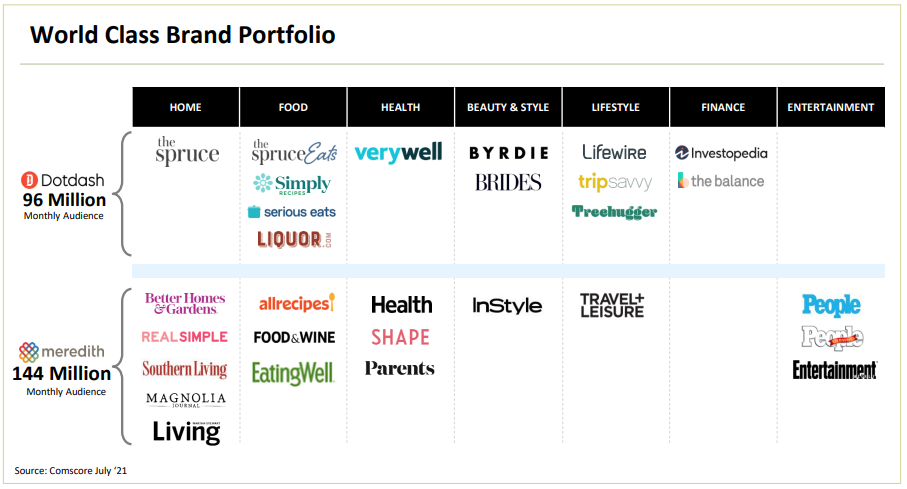

Background: prior to IAC’s acqusition of Meredith, DotDash was IAC’s fast-growing online publisher unit, and a serious challenger in lucrative sectors such as Health (verywell), Travel(tripSavvy), Finance (investopedia), Beauty (theSpruce) and Home(Byrdie), in many cases competing with more established Meredith.

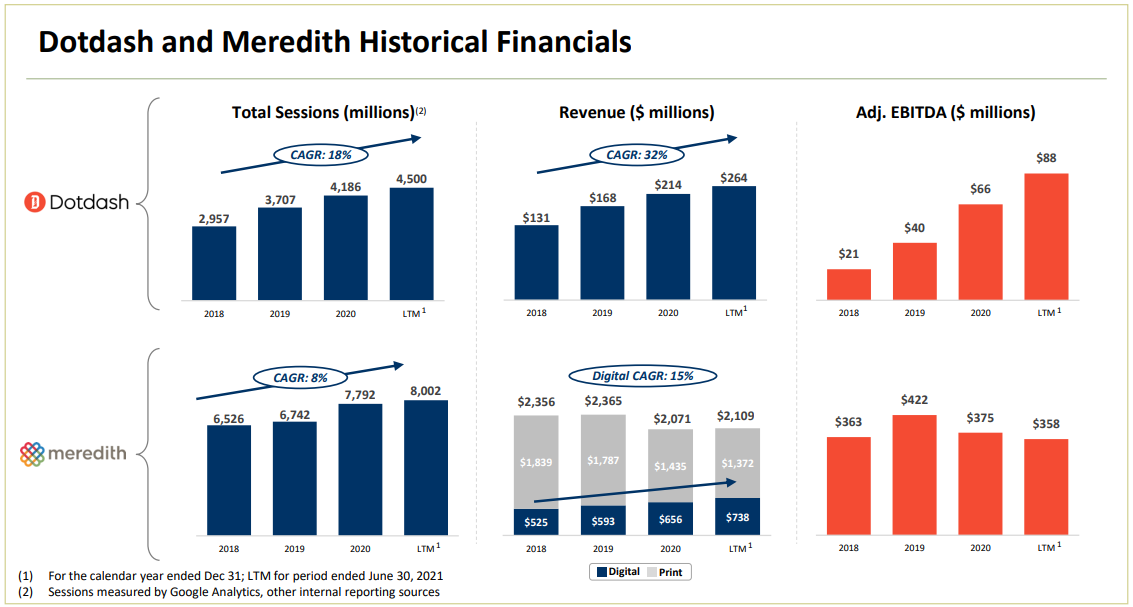

Its revenue grew from $131Mn in 2018 to $264Mn in 2021, 32% CAGR prior to the acqusition. Equally impressive, its adj Ebitda margin improved from 16% in 2018 to 33% in 2021, 1700bps in 3 years.

DotDash attributes its success to its 3-dimension playbook:

Content (offer superior content, e.g. investopedia v.s. click farm garbage)

Technology (more responsive sites, faster page loading)

Ads (fewer/respectful ads, better user experiences)

It had an intriguing acqusition rationale: By combining world-class brand portfolios, Dotdash and Meredith became the category leader in many advertisement-lucrative verticals (see chart below) outside of the Google+Meta wall garden.

It intended to leverage Dotdash’s playbook to improve Meredith’s site core competency thus attracting more performance marketing for Meredith, while leveraging Meredith’s advertising network to further improve Dotdash’s brand advertising revenue.

IAC paid $2.7B, 8x ev/LTM Ebitda, for Meredith. It projected 15-20% digital growth, which offset moderate Print decline, plus some operating synergies saving. It targeted $450Mn adj Ebitda for Y2022.

The reality deviated from that. In its 3Q22 letter, 1 year into Meredith's acqusition, Joey Levin said:

Just over a year ago, we announced a definitive agreement for Dotdash to acquire Meredith to form the biggest digital publisher in the industry. At the time, both companies were registering record online audiences and 25% combined Digital revenue growth. In hindsight, we timed that acquisition poorly.

I compiled below the last 6 quarters’ management commentary about DotDash Meredith. You can notice how the management sentiments shifted from optimistic to conservative over the quarters.

Now let us turn to the quantitative side of the story.

pre-acquisition, DotDash $0.25Bn rev LTM, 30% Ebitda margin. Meredith $0.75B digital, and $1.4B print revenue.

As of 2Q23, DotDash Meredith did a combined $0.9B digital and ~$0.9B print revenue over the last 12 months.

IAC initially projected $450Mn EBITDA. Here is my interpreted math:

combined digital pre-acquisition revenue $1Bn, grow 20% to $1.2Bn in Y22. Applying a 25% EBITDA margin (pre-cost saving) to $300Mn.

$1Bn print revenue (shrink 20% vs pre-acquisition), 10% margin to $100Mn

$50Mn cost savings.

So the gap is mainly due to declining digital revenue, with a collapsed margin.

If we look at $250-300Mn EBITDA target (2023), it is largely based on digital and print revenue stabilized at $1B each, with 20% and 10% adj EBITDA margin respectively (post synergy cost saving).

That doesn’t seem aggressive. Of course, examining DotDash Meredith's last few quarters’ results, you have to concede anything is possible.

Let me acknowledge I don’t have a clear conviction about what the future looks like for DotDash Meredith. For that reason, I won’t get into serious valuation exercise other than point out the following:

At $250Mn Ebitda, 6x Ev/Ebitda multiple, and $1.5Bn LT debt, this biz would be 0, possible but feels very depressed scenario.

At $300Mn, an 8x multiple, and $1.5Bn LT debt, it is a $1Bn value, a reasonably conservative, but feels realistic scenario, IMO.

Risks

MGM exposure: a big portion of IAC’s value is tied to MGM. If MGM goes down, it would bring IAC down. I have a relatively positive view of MGM, it has premium resort portfolios, a wide range of geographic coverage, (Macau, Las Vagas to US regionals), and is led by an experienced team. A deep dive into MGM is beyond the scope of this analysis, also it could be effectively hedged if one chooses to not undertake that risk.

A similar, but to a lesser degree concern applies to ANGI. I have less conviction about it, but at a $700Mn market cap, it becomes an increasingly smaller portion of the whole IAC story.

Failure to turn around Dotdash Meredith: if you go over the section above, it shall not surprise you I consider this asset becoming a zero a possibility (though quite remotely). It overpaid Meridith during its peak earnings, at a sector average multiple. So my expectation is low here - back to the acqusition value story ($2.7B acqusition cost + ~$1Bn DotDash valuation) is not in my card.

Further Turo IPO delays: it is absolutely possible. What I took comfort in Turo is it is already a slightly profitable business, with a sufficient amount of cash to weather turmoils within a realm of reasonableness, and no urgency to raise capital right away, I consider that to be a major plus.

Parting Thoughts

If you are still with me, thank you and I appreciate it.

My work is tailored towards curious-minded investors, who like to explore new ideas/industries, dig deeper, and make their own decisions. My goal is to be a part of your research process, provide relevant info, play the company's (and industry’s) movie in the past, and offer your insights/model to project what the future holds.

If that is of interest to you, please subscribe and share it with your friends.

Excellent write up on a business I had no idea existed. I would agree with you on the merged publisher business being closer to a $0 than anything else