Dole: This Banana Tree has 3 Upside Branches

Selling non-core assets, de-lever bs, amplifying valuation gap, by a disciplined owner/operator.

Introduction

Dole DOLE 0.00%↑ , a well-known US household brand, was listed on NYSE via a complex reserve triangular merger in Aug 2021, including its parent co (Total Produce) delisted from Euronext Dublin.

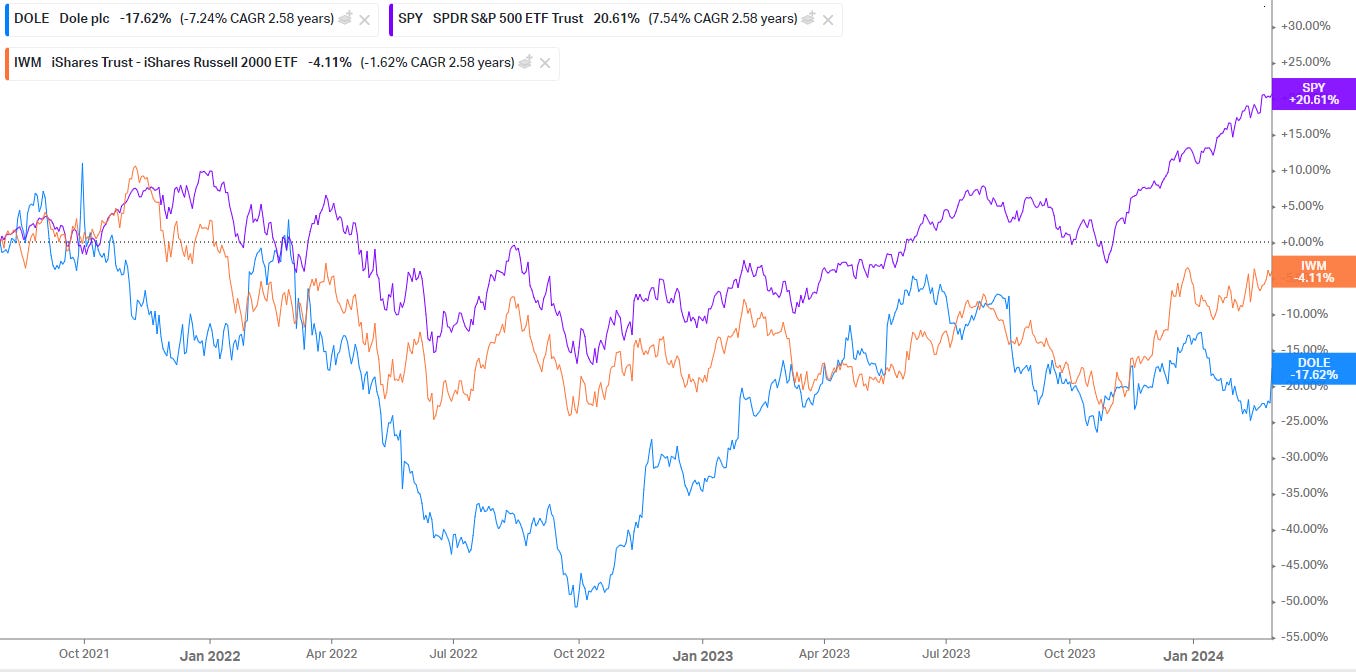

Since IPO, its relative performance lags behind S&P500 and Russell by a long mile (37% and 13%), and currently has a market cap of $1.1Bn, enterprise value of $1.9Bn, and LTM Ebitda at $385Mn.

Whilst common for a newly listed co (esp. from overseas exchange) suffer short term valuation discount, that argument becomes pale after 2.5 years. It is time for any responsible longs to reassess.

Thesis Summary

A sizable valuation gap exists (and expanded) between Dole and its peers, and between Dole and its 2 business units that are pending sales.

While legacy Dole had unique/attractive assets, its daily operations weren’t managed to a consistently high standard. That changed as a part of Y21 IPO, when the power transitioned from Murdock (legacy Dole) to McCann (Total Produce), who had a 2-decade public track record as a disciplined and shareholder friendly owner.

They are not sitting idle on the valuation gap. The management is proactively unloading non-core (less-performing) assets at a multiple much higher than its valuation and de-lever the balance sheet.

Above three, if held steady, is a powerful combination that make the stock an attractive buy for long term investors.

Let us unpack these 3 factors.

Valuation Gap

Dole currently trades at 4.9x EV/LTM Ebitda

Dole Market Cap $1.1Bn as of 2/29/24 (95.2Mn shares, $11.8/share). It has ~$0.8B net debt ($1.1B debt, ~0.3Bn cash), $1.9Bn EV, and $385Mn LTM Ebitda.

Dole’s LTM Ev/Ebitda is at least 2 turns cheaper ( FDP 0.00%↑ ) compared to its US fresh food procuders.

Next, let us examine 2 recent pending sales.

Last month, Dole announced the sale of its 65% equity stake in Progressive Produce to Arable Capital for gross cash proceeds of $120Mn.

Progressive Produce annual sale is “over $400Mn” according to the release.

It is a part of “TP Produce - ROW” segment, with average segment Ebitda margin around 2.5% to 3% since 2020. If we use its segment margin for modeling, its entire biz annual Ebitda is ~$12.5Mn. 65% of that is $8Mn Ebitda.

Assuming the proposed sale carries no additional debts, that would value Progressive Produce at 15x Ev/Ebitda.

In Jan 2023, Dole announced the sale of its Fresh Vegetable division to Fresh Express for $293Mn. Its annual sales is $1.2-1.3Bn, and wasn’t profitable (it lost $33Mn ebitda in Y22) due to salad recall related incidents. If we trace back to Y2020 it registered ~$40Mn ebitda/year at its peak.

That would still value the unit at 7.3x Ev/Ebitda, despite using its peak earning.

Shall I remind the readers Dole is currently trades at 4.9x Ev/Ebitda?

Unload assets/De-lever

Now, the bear would counter you can cry low valuation all day long, it could stay low for long. Give the credit where credit is due, the bear has been right, Dole’s performance over the last 2 years have been disappointing.

Yet, Dole management is not sitting idle (crying), it made it clear that the proceeds from the sales would be used to reduce debts.

In Progressive Produce’s case (estimated closing in March 2023), it would reduce debts by 9% ($100Mn), and only reduce Ebitda by 2% ($8Mn).

If you wonder whether Dole takes de-lever commitment seriously, just check out its net leverage ratio over the last 8 quarters.

It is worth noting this is not a coincidence, rather deliberate choices Carl McCann, a shred business operation and capital allocator, continues to make.

This leads us to the last (but not the least) part of the thesis: the decision-making power transition from Murdock (previously majority owner of Dole) to McCann (Total Produce founder since Y06, a large shareholder, and current Dole chairman)

From Murdock to McCann

Murdock family, (via C&C) has 12.6% ownership of Dole plc. McCann family (via Balkan Investment) has 7.7%. They are the 2 largest shareholders.

It is worth noting despite Murdock’s initial intent to sell some of its stake during IPO, he didn’t sell any since, as the price didn’t hit the initially set floor price of $18.

David Murdock (founder of legacy Dole), at age 100, had six marriages, and 3 children (sons). Sadly 2 died (both due to accidents), and the remaining one, Justin Murdock, while had some oversight role in legacy Dole, never took on hands-on responsibilities, and his reputation, to put it mildly, is not an exact fit to a public co executive.

On the other hand, McCann family, since Total Produce spin-off from Fyffes in 2007, achieved a total return of over 400% in 14 years, outstanding shareholder value creation, especially considering a total return of -10% for the ISEQ (Irish stock market index, now Euronext Dublin) during the same period.

Not that I intend to gossip here (esp wrt Murdock family), I try to establish the rationale why Murdock sold his business, and why to Total Produce.

Back to Basics

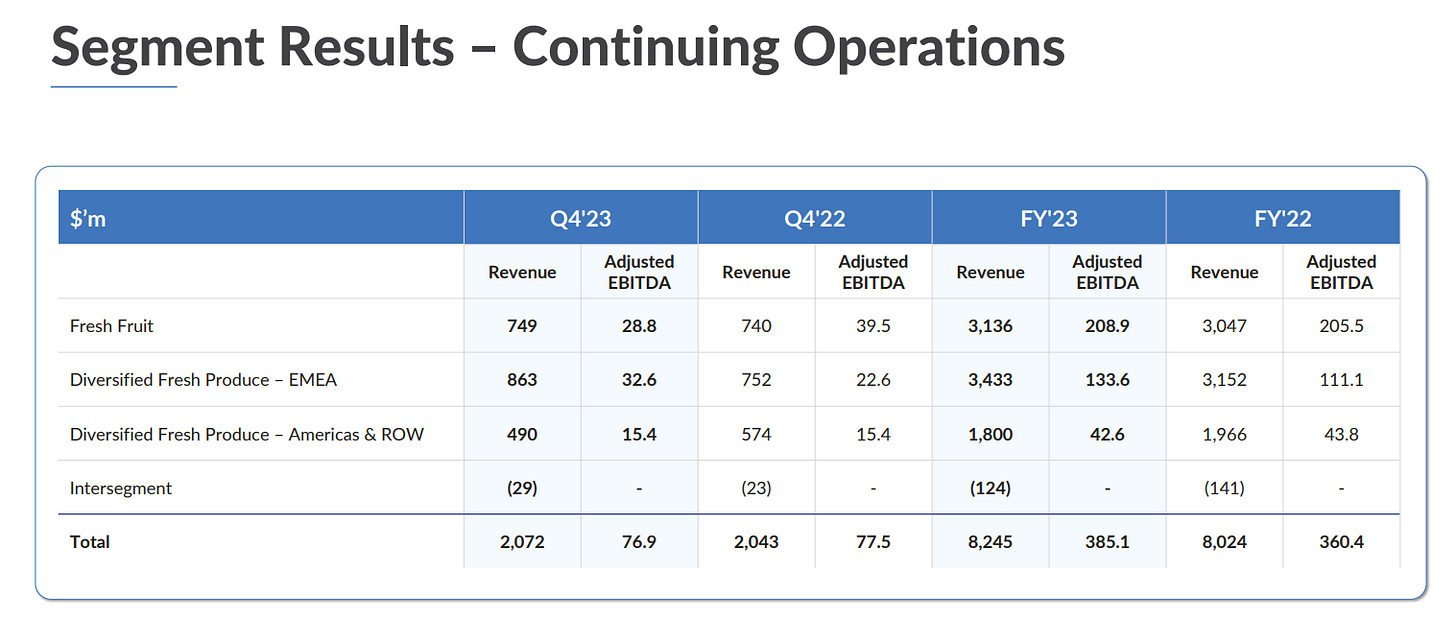

If you find the above 3 intriguing, let us get back to basics: Dole's core business has 3 segments: Fresh Fruit (from Legacy Dole), EMEA Produce, and US/RoW Produce (from Total Produce).

Its total annual sales are ~$8Bn+, $3Bn Fresh Fruit, $3.4Bn and $1.8Bn for the other 2.

As a vertical integrated player, Fresh Fruit is the crown jewel with the highest Ebitda margin at ~6.5%, and EMEA and RoW Produce at 3% +/- 0.5%.

Its normalized Ebitda, excluding Fresh Veg (pending sale), is between $350-$380Mn / year. Its Y2024 Ebitda guides at $385Mn, the same as Y2023.

Here is its segment level results from its 4Q23 ER slides.

If you are interested in more details, Value Situation had an excellent analysis from 2021.

Connect the Dots

Dole has a simple yet effective playbook.

While it continues to maintain profitability level, it strives to unload non-core (less performing) assets at a multiple higher than its valuation, and using its proceeds and operating cash flow to de-lever balance sheet.

As a result, its net debts is reduced from $1.3Bn in 3Q21 to $0.8Bn in 1Q24. Consequently, its Ev/Ebitda multiple dropped to sub 5x, significantly below its fresh produce peers.

That combination is a force to reckon with. For example, if both Progressive and Fresh Veg deal goes through and proceed to repay debt, it would reduce its EV to 1.55Bn, and Ebitda to $375Mn, resulting in 4x Ev/Ebitda.

Furthermore, debt reduction would further improve its Ebitda to FCF conversion rate. Each $100Mn debt reduction translates to $8Mn interest saving.

The Movie Forward

While I can’t predict stock price movement, I believe this management team will continue to execute the playbook in a disciplined and shareholder friendly way, that is, continue to unload non-core assets (as long as private vs pubic valuation gap remains meaningful), it will use the proceeds and free cash flow to de-lever the balance sheet. It will continue to pay dividend (currently $0.32/share per year), and when time is appropriate, it might consider buyback as well.

All these measures will maginfy the valuation gap between Dole, its public peers, and private deals assuming the stock price remains flat. I just can’t rationalize that in the long term, as Benjamin Graham put it: the stock market is a voting machine in the short run, but a weighing machine in the long run.

Risks and Bears’ Thesis

Poor ebitda to free cash flow conversion (35%):

Napkin math: $380Mn ebitda, $100Mn CapEx, $80Mn net interest, $40Mn tax, $30Mn to non-control interest.

That calculates to a normalized $130Mn free cash flow (35% ebitda to FCF conversion). This excludes Fresh Veg unit P&L (a loss of ~$20Mn LTM), and/or proceeds from pending asset sales.

I agree the conversion rate is low, to be fair common for high CapEx and heavy debts companies. On the other hand, if Dole continues the debt repayment trends at $150Mn/year, it will increase FCF (interest saving) by $12Mn a year, thus FCF $150Mn+ by EoY2025. If Dole remains at its current stock price, by then its Ev/Ebitda would be 4x, a valuation unseen anywhere globally in this industry, not to mention Dole is No 1 fresh produce producer in terms of market share.

Fresh Vegetable sale will be blocked:

That is certainly possible. The sales was announced in Jan 2023, the process takes longer than expected. The management hinted challenges during regulatory review process, therefore there is a real possibility that it might be blocked, and I assume the stock could go further down with that news.

In terms of impact, Fresh Veg segment turned $5Mn profit in 4Q23 (after nearly 8 quarters operating loss), fair to say the worst is over. If the sale doesn’t go through, it certainly will slow down debt reduction progress, but other than that, at least I feel hopefully that it is at least ebitda accretive.

Parting Thoughts

If you are still with me, thank you and I appreciate it.

My work is tailored towards curious-minded investors, who like to explore new ideas/industries, dig deeper, and make their own decisions. My goal is to be a part of your research process, provide relevant info, play the company's (and industry’s) movie in the past, and offer your insights/model to project what the future holds.

If that is of interest to you, please subscribe and share it with your friends.

Disclaimer: I have a long position in DOLE

I'm not sure I would call this a value play to be perfectly honest.

This is a low margin commodity business in a highly competitive market that has regular losses and where I'd normalize the earnings at maybe 100 million per annum.

Paying 1100 million in market cap for 100 million per annum gives you a 9% yield or an 11 PE. That's not super high sure, but certainly not low.

I wouldn't except any growth here since as you mention they are selling off non-performing assets, and in any case this isn't exactly a growth industry and they are already as big as they will get imo.

I can see a "re-rating" happening as a result of the deleveraging and better performance... but what would it re-rate to? The same value as today?

How much would you pay for an inflation adjusted annuity that pays out 100 million a year while being subject to credit risk similar to dole equity?

I think 11 pe is a fairly decent value as is for that IMO, and can't really see myself paying more. so why would someone else?