Golar LNG: Elite Assets Plunged 25%

overreacted and unwarranted, the market offers a 2nd chance to buy

Introduction

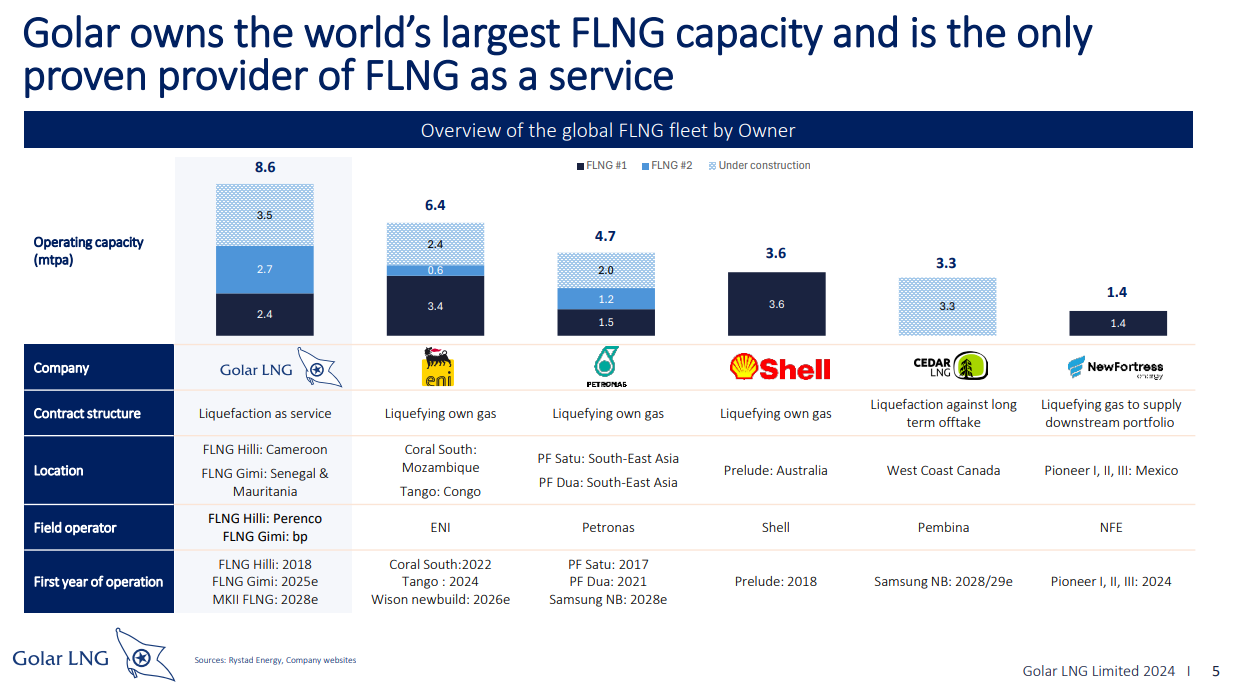

FLNG (Floating Liquefied Natural Gas) is an offshore floating vessel that processes, liquefies, and stores natural gas. Each costs billions to construct, with 8 currently in operation worldwide. Golar LNG GLNG 0.00%↑ is the largest and only independent player, holding ~30% in-service and pipeline capacity.

Despite its favorable position, Golar’s stock plunged ~25% from its January peak as the market reacted to TTF (EU Natural Gas futures) weakness and fear of Europe reverting to Russian gas dependence.

This offers a chance to own a quality business amid a market-engineered distress, and my analysis below shows that the recent 25% price drop (a ~$1.2Bn Market Cap loss) is unjustified.

Thesis Highlights

At $32-33/share, 104Mn shares, and $0.7Bn net debt, Golar LNG EV is ~$4Bn.

Its 2 in-contract FLNGs, Hilli and Gimi, have a capacity of 5.1 Mpta (million tonne per annum). It generates ~$450Mn EBITDA once Gimi COD starts (Commerical Operations Date, ETA 2Q25) and increases to an estimated $500Mn when Hilli’s 20-year contract begins in 2027.

Besides Golar’s two, six other FLNGs are in service. Their costs range from $1Bn to $3Bn/Mtpa. Using the low-end cost of $1Bn/Mtpa, Golar’s two FLNGs market rebuild cost is $5.1Bn, 27% higher than GLNG’s total EV.

$4Bn EV values these two vessels at 8x EV/EBITDA, a non-demanding one given their 20-year binding contracts with large integrated gas/oil majors.

Furthermore, the 3rd FLNG (MKII, 3.5 Mtpa, under construction) can(*) generate $500M EBITDA annually and is expected to enter service by EoY2027. This adds up to ~$1B EBITDA by 2028, a 5.6x EV/EBITDA using today’s EV, including an additional $1.6Bn to complete MKII.

Additional upside optionality includes its 10% ownership of Southern Energy and a 2nd MKII build option with a 3.5Mtpa capacity.

* Updated on 3/19/2025

According to Horacio Marin, YPF CEO, in a speech1 at the Latam Forum on 3/18/25

Today I can tell you that we have three phases. Argentina LNG 1 (Vaca Muerta project), which is going to be, is not yet a relevant fact, but we are finalizing the final agreement with a company to bring two ships together with PAE, Pampa, and Harbour Energy . We will have six million tons, the equivalent of 24 million cubic meters per day, which will be available starting in September 2027, and we hope to have the second ship ready by 2028

Hilli is awaiting FID in Vaca Muerta, and Hilli (2.45 Mtpa) plus MKII (3.5 Mtpa) totals 5.95 Mtpa. Though Marin didn’t disclose the name(s), Hilli+MKII aligns with both capacity (6 Mtpa) and timing (EoY 2027). My spider sense thinks YPF could make the formal announcement on April 11 (YPF Investor Day 2025). If my hunch is right, re-rating catalyst comes soon.

Outline

The first two sections explain FLNG’s role in the complex global natural gas market and why it is not as cyclical as the market often perceives.

The following sections explore Golar’s strong market position, advantages, and the disparity between its asset value and stock price.

Natural Gas and LNG, and how FLNG fits into that landscape.

LNG/FLNG supply and demand, LNG pricing disparities, and unit economics.

Golar’s story, its advantages in cost, agility, and reliability.

Vessels walkthrough, their history, cost, and economics.

Napkin math and its valuation.

Natural Gas, LNG and FLNG

Natural Gas represents ~1/5 of the global energy consumption. It is cleaner than coal/oil, abundant (often a byproduct of shale oil drilling), and cheaper (natural gas is ~20-30% of Brent Oil price when measured in energy contents, e.g., $/MMBtu).

The challenge lies in transporting Gas from regions with abundant supply, e.g., the US, Canada, and Qatar, to areas with high demand, e.g., Asia (China/Japan) and Europe. This is where LNG (Liquefied Natural Gas) becomes essential; natural gas is cooled to a liquid state at -162°C, at 1/600 of volume, for economical storage and transport.

The diagram below depicts a typical (non-FLNG) offshore gas workflow from extraction, pipeline to plants, processed and liquefied in the plants, kept in storage tank, and shipping via LNG carrier to destination.

Pipeline and liquefaction plants are large CapEx items. A mid-to-large scale plant costs $5Bn to $20Bn (~$1Bn/Mtpa), and 4-6 years to build. When a gas project is far from shore (>200km) and/or a small reserve, building pipelines and shore-based facilities becomes economically unviable and infeasible to maintain, thus considered a stranded resource.

That’s when FLNG (Floating LNG) comes to play. It is a liquefaction plant on a vessel moored to the operating site. It replaces pipeline and onshore liquefaction plants, making otherwise stranded gas projects economically viable.

FLNG Market

Limited Supply: There are 8 FLNGs in total, all in service. Golar has two, representing ~1/3 capacity. 5 liquefies its own gas, and one serves its downstream portfolio. Golar is the only independent FLNG contractor.

Growing Demands: Total LNG trades were 407 mtpa in 2024, project to grow 2-3% CAGR to 630-718mtpa by 2040 (Shell’s LNG outlook 2040), driven by Asia (China/India’s growth) and Europe (reduced Russian import), energy needs growth, offset by net-zero efforts to replace NG with renewable energy.

Pricing Disparity: The Recent LNG price in Asia (JKM Price) and Europe (TTF) is ~$12-14/MMBtu range. In North America, LNG is a small niche market; its price is ~$6-7/MMbtu, based on Henry Hub spot price (~$4/MMbtu) plus liqufaction cost ($2-3/MMbtu), thus half the price of Asia and Europe.

This price disparity arises from oversupply in regions like the US, which has abundant shale gas, and limited domestic productions in places like Japan and Europe. This structural imbalance incentivizes long-term large capital investment, including FLNG, to facilitate LNG trade.

Unlike efficient markets, where price differences are quickly equalized, LNG price disparity arises from structural imbalances and likely persists, offering a solid foundation for FLNG bulls.

Unit Economics: Let us walk through the Natural Gas value chain from extraction (in North/South America) to delivery (Asia/Europe) to understand the cost of each step and its sensitivity to the LNG price movement.

Gas Exploration + Production: $0.5-3/MMbtu

FLNG tolling/liquefaction: $2-3 /MMbtu

Shipping: $1-3/MMbtu

Regasification $0.5-1/MMbtu

It adds up to the total cost of $5-10/MMbtu (delivered to European or Asian ports) vs the current price of $12-14/MMbtu in Europe (TTF) or Japan (JKM), which shows a compelling business case and plenty of profit margin to facilitate LNG trade.

Midway Recap

The world consumes ~3100 mt (million tonnes) of natural gas annually, with LNG making up ~13% (407 mt in Y2024), up from 3-5% in the late 90s.

FLNG’s 15mt capacity accounts for only 3% of LNG trade (from 0% in 2017), making it a tiny portion of the vast natural gas market.

Let us discuss Golar next.

Golar’s History

Golar LNG was founded in 1946 in Norway as a traditional shipping company. It entered the LNG sector in 1970, signaling a shift toward energy transportation. In 1997, Singapore-based Osprey Maritime acquired it. In 2001, John Fredriksen took control, rebranding it as Golar LNG. The company went public in Oslo in 2001 (later delisted in Y12) and on Nasdaq in 2002. Golar pioneered FLNG technology with the Hilli conversion in 2018 and has since transformed from an LNG carrier to an FLNG-as-a-service contractor.

Golar’s Advatnage

Lowest Cost: Golar’s average build is $500-600 million per Mtpa, less than half its peers’ average ($1-1.5 Bn per Mtpa). Leveraging its experience and assets, it takes the LNG carrier conversion approach to build FLNG. It chose Black & Veatch (PRICO technology) for liquefaction, which is known for modular designs tailored to small- to mid-scale capacity (less than 5 Mtpa).

Hilli: $500Mn/mtpa ($1.2Bn build cost, 2.4mtpa)

Gimi: $600Mn/mtpa ($1.6Bn, 2.7mtpa)

MKII: $600Mn/mtpa($2.2Bn, 3.5mtpa)

That compares favorably to all other currently in-service FLNGs.

Keep reading with a 7-day free trial

Subscribe to Under The Hood to keep reading this post and get 7 days of free access to the full post archives.