Sable Offshore: Legal Arbitrage On California Coast

SPAC, offshore oil/gas asset, regulatory battles in CA, could it be more challenging?

Disclaimer: A dynamic spec-sit. The stock may experience high volatility. DYODD. I have a starter position.

Background

Its sole asset is an offshore oil and gas package with comprehensive end-to-end infrastructure, massive reserves, and a long, profitable operating history. The company, through its former SPAC, acquired it from Exxon at a ~1/10 price tag of comparable assets in Y24.

The company is Sable Offshore SOC 0.00%↑, and the sole asset is Santa Yuez Unit (SYU).

Exxon is not a naive seller. Selling at 1/10 of the market value has its reasons. Sable Offshore, led by James Flores, an industrial veteran, is not a naive buyer either.

It is a story of politics, energy, regulations, and fierce battles between offshore drilling and environmentalists in California.

Outline

There is no shortage of views on Sable, but most are extreme, from "$10 Bn+ assets crazily valued at $3 Bn", to "It won't work in CA, thus a zero."

Many detailed real-time legal analyses. They are great (e.g., @JasonStrom84409 on X), but newcomers may lack the context to grasp and assess relevance.

This article intends to fill the gap. I discuss Sable’s assets, its catastrophic past, and its complex present, introducing the parties involved, their incentives, and more.

I also strive to provide a balanced view and an objective fair value assessment.

One barrier to keeping up with the story is the long list of involved parties (all with acronyms) in various analyses. I keep a cheat sheet and share it with you at the end for your reference.

Thesis Highlights

Despite several regulatory breakthroughs and a successful trial restart, Sable is still perceived as a hopeless offshore oil story that will never see the light of day in California. I call that perception deviates from reality.

If Sable clears all regulatory hurdles and aligns valuation with peers, its stock could reach $58 to $90 per share, a 140% to 275% upside.

One might push back, that’s a big if. Agreed, but even considering all legal risks, my model shows the stock should be valued at $26 to $42 (midpoint: $34). Currently at $24/share, a 40% upside to the midpoint.

Assets

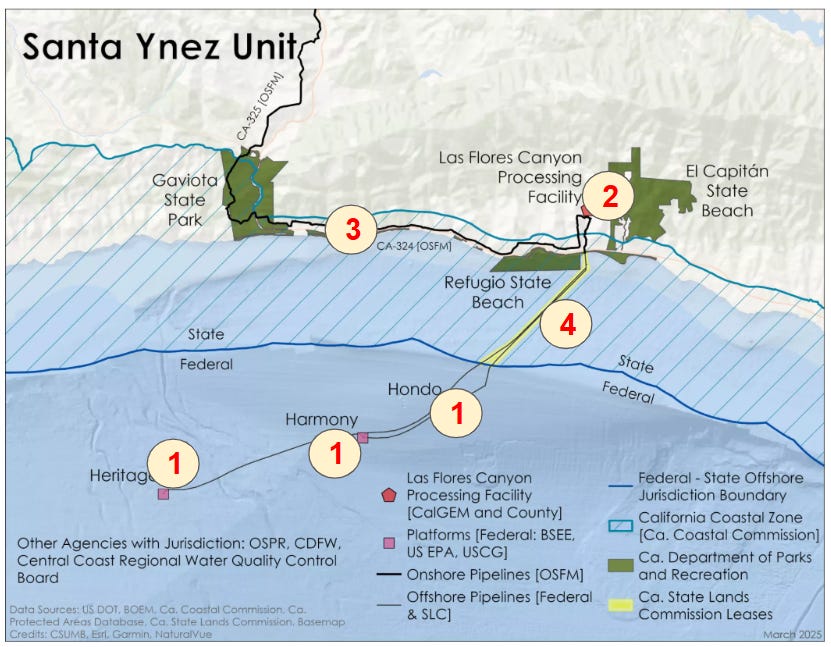

I will tell the story first through its assets. Santa Yuez Unit (SYU) is an end-to-end oil/gas infrastructure with 4 major assets acquired from Exxon in Y24.

3 Offshore Oil Platforms (Heritage, Harmony, Hondo), 5 to 9 miles offshore in shallow water of 900 - 1200 feet.

Onshore Processing Facility at Las Flores Canyon (total 1480 acres, 35 acres occupied by facilities).

Las Flores Pipeline System: CA324, 325 (formerly Pipeline 901 and 903), previously owned by Plains All American Pipeline (PAAP), idle since the 2015 Refugio Oil Spill. Exxon acquired in 2022.

Offshore Pipelines: Some in federal water and some in State water.

SYU is no ordinary offshore oil asset. Under Exxon, it has produced 671 MMBoe since 1980, at a production rate of 29MBbl/d oil, and 27 MMcf/d in 2014 (last full year production). Put into perspective, it is roughly 10% to 15% of California’s in-state production, a vital energy source given that California imports ~60% of its crude oil from overseas and 90-95% of its natural gas from other states.

The Spill

It came to a sudden stop in May 2015 with the Refugio Oil Spill. The incident spilled an estimated 100k to 450k gallons of crude oil, with ~20% reaching the ocean. The rupture was caused by pipeline corrosion (No. 3 in the diagram above) near Refugio State Beach, and the spill contaminated the coastline, killed marine life, and forced beach closures for weeks, with an estimated economic impact of $250-350 Mn. The entire SYU was shut in.

As the pipeline owner, Plains All American Pipeline (PAAP) was found guilty in 2018. It reached two settlements, totaling $290 million, and accepted a 2020 Consent Decree issued by a federal district court. It defined the restart requirements.

Exxon’s Attempts

Exxon initiated its restart attempt (with PAAP) shortly after the spill, and the strategy involves three plans: “Fix it”, “Rebuild it”, or “Bypass it (via Oil Truck)”. Facing consistent community resistance, Exxon had no success in any of the three options over half a decade. It was sold to Sable in late 2022.

The Sale

The sale to Sable was announced in 2022 and finalized in February 2024. Its key terms are:

Sold for $ 643 Mn, with a $690 Mn loan financed by Exxon.

Exxon has an option to take back the assets if Sable fails to restart production by Mar 2026 (revised from Jan 1, 2026).

We will revisit the sale later. For now, let me try to answer the obvious question: What led Sable to think it can achieve a restart that a far more resourceful and larger Exxon couldn’t?

Sable’s Strategy and Execution

Sable’s strategy centers around the 2020 Consent Decree, which clearly defined the required steps (in Appendix D) to restart pipelines. As the opposition to the restart that Exxon faces primarily originates from the local county level, Sable’s strategy is to pivot its focus to federal and state-level approval, arguing that its offshore platform is located in federal waters and that its pipelines are state-regulated, thereby marginalizing the jurisdiction of Santa Barbara County. It also maintains an aggressive legal stance towards the county, including suing the County in federal court in May 2025.

Another factor that plays to Sable’s advantage is that in recent Santa Barbara County (SBC) votes regarding Sable pipelines, the votes always end in a 2-2 tie, as its 5-member board is divided, with one member (who opposes Sable restart) recusing her vote due to conflict of interest (the pipeline passes her property). That leads to everything at the SBC level remaining status-quo.

With the above, Sable has made solid progress towards SYU restart. Some key achievements are:

Complete repair and restore to “as-new” condition: (as of May 18, 2025, SOC reported completing all repair program)

Installed 16 automatic Shut-off Valves: Complied Bill 864 (2015), and meet the standards of OSFM and DOT’s PHMSA.

Corrosion Protection/Monitoring: OSFM granted a waiver for the cathodic protection requirements in December 2024.

Pipeline Hydrotesting and integrity verification: 7 out of 8 done. final test pending.

Remaining Work / Obstacles

Complete the 8th (final) hydrotesting.

Resolve 1 preliminary Injunction and 1 Temp Restraining Order (TRO): details in a later section.

Pending Regulatory approvals:

OSFM (startup plan and final hydrotesting approval)

CSLC (lease transfer and right-of-way approval)

Legal Case Overall Assessment

As I covered Stable’s legal strategies, progress made, and remaining work, let me provide a current state assessment.

Keep reading with a 7-day free trial

Subscribe to Under The Hood to keep reading this post and get 7 days of free access to the full post archives.