Valaris: Quality Assets at a Distressed Price

25% off since Jan due to interim whitespace despite strong Y26 outlook, now 75% off build cost.

Introduction

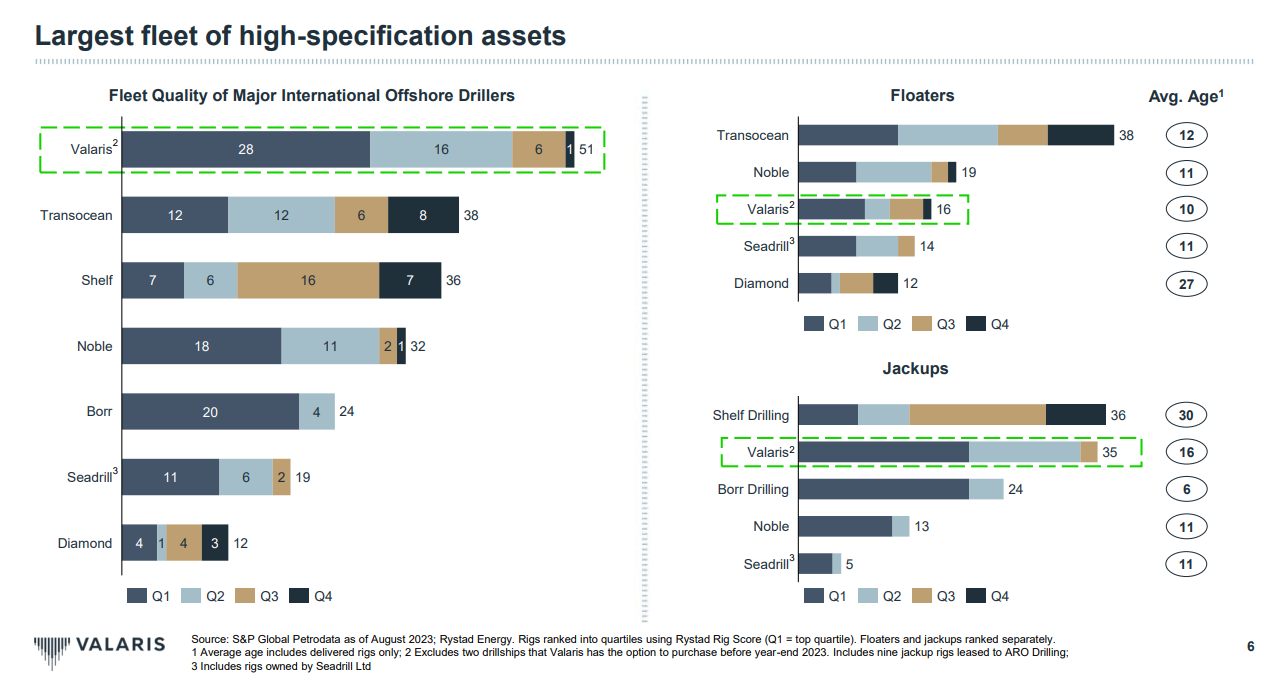

Valaris VAL 0.00%↑ is one of the largest offshore drilling contractors, servicing 8 of the top 10 National and Independent Oil Companies (NOC and IOC) globally.

Its fleet includes 13 drillships, 2 semi-subs, and 33 Jackups, which account for 14%, 7%, and 7% of the market share in each category.

One Picture Pitch

This picture shows 2 Valaris assets: a DS-09 drillship and a Valaris 249 Jackup.

Valaris acquired DS-09 for $640Mn in 2014 and Valaris 249 Jackup in 2003 (estimated ~$150Mn).

One might think I cherry-pick its crown jewel assets to make a compelling case; No, they are just two of Valaris’ “average Joe” assets. Using a build cost of $600Mn for drillships, $150Mn for Jackups, and $300Mn for semi-subs, Valaris’ entire fleet adds up to ~$13.4Bn ($0.6*13 + $0.15*33 + $0.3*2).

At ~$38/share, 71Mn outstanding shares, and ~$0.7Bn net debts, Valaris’ $3.4Bn enterprise value is ~25% of its fleet build cost.

These are not low-quality assets. 12 out of 13 Valaris drillships are young 7th Gen (only two 8G in the world), and more than half of its fleet is in the top quartile, the highest among peers.

Furthermore, build costs have increased significantly with increasing material and labor costs and reduced shipyard capacity (many yards exited the business after 2014). A ~$600Mn 7G drillship in 2014 would cost $850Mn+ today.

But It is Offshore Drilling…

Long-term investors despise Offshore Drilling for good reasons.

Sizeable upfront capital investments, cyclical and heavily reliant on macro factors, make bankruptcy a typical end game. Valaris, Noble, Diamond, and Seadrill, 4 major offshore drilling contractors, all filed for bankruptcy during the 2020-21 downturn.

Why should investors ever give offshore drilling a chance? I propose two scenarios that deserve a serious look:

A company goes through bankruptcy, which is designed to strengthen its position and benefit future shareholders at the expense of previous equity owners and creditors.

Market sentiment is unjustifiably low, where perception deviates far from reality.

Today, I believe Valaris fits both criteria.

Outline

I briefly discuss Offshore Drilling.

I review Valaris’ 2020 bankruptcy, its emergence to a 2021 IPO, the progress made since, and how its stock went up 4x and then lost half recently.

I present a napkin math showing how distressed Valaris’ assets are valued.

I dive into unit economics, taking a profitability walk from rig to company level to show key levers and their impacts on earning power.

I summarize its valuation and bear/base/bull case scenarios.

Offshore Drilling

Offshore drilling extracts petroleum beneath the ocean floor. Bottom-founded rigs (Jackups) work near shore up to 500ft in water depth; deepwater mobile floaters (Semi-Submersibles, drillships) are further away and can work up to 10 to 12k ft deep.

Offshore drilling has long cycles. Higher oil prices lead to higher rig day rates, and higher profits lead to increased CapEx for rig build. Conversely, idle drillships during demand drops incur high maintenance costs and lower utilization. This chart shows long cycles of multiple-year rig addition (or deduction) from the working fleet once a trend is established.

Next, let us take a look at Valaris.

Valaris: Bankruptcy to IPO (2020-21)

Valaris’ 2020 bankruptcy and emergence to 2021 IPO through financial restructuring is a textbook debt-to-owner success story. One of the key players/beneficiaries is Oak Hill Advisor (OHA).

As a distressed debt investor, OHA acquired Valaris’ debt at distressed prices during COVID-19 and became the largest debt holder. It worked with other creditors and filed Chapter 11 in Aug 2020. The restructuring achieved:

Eliminated $7.1Bn debts and issued new common shares to creditors.

Injected $520Mn capital (in the form of 2028 secured notes)

Canceled existing common shares, issued 5.6M warrants at $131.88 with 7 years expiration; the price, if reached, all note holders receive 100% claim recovery.

Granted rights to take 2 drillships (DS-13/14) at a deeply discounted $340Mn, which Valaris took in 2023. They were ordered initially for $1.27Bn.

new IPO at $1.5Bn market cap

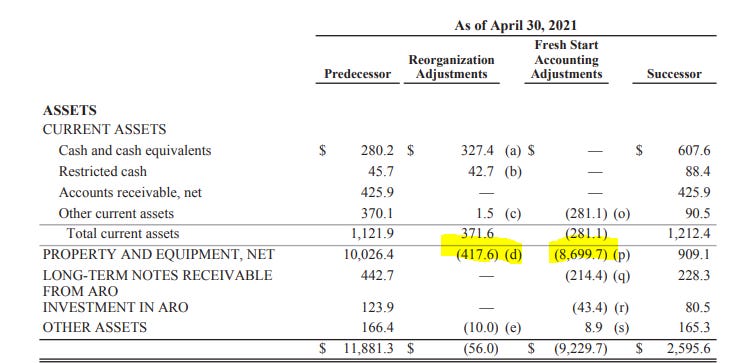

After restructuring, Valaris adopted a fresh accounting start, reducing $7Bn+ debts and $9Bn PP&E, a key point in the story we will revisit later.

OHA invested $175Mn, including $75Mn in secured notes (out of $550Mn) and $100Mn debts that converted to ~9.4Mn shares (largest shareholder at 12.55%). It sold ~50% at $73 (~7x return), holding 4.8Mn shares. OHA has a BoD seat.

Famatown Finance is another major shareholder, owned by John Fredriksen (a billionaire and richest Norwegian, former CEO of Frontline).

Fredriksen acquired 5% of Valaris (at ~$30/share) in December 2021 and increased his position at higher prices in January, June 2022, and late 2024. His latest addition was on November 24 at ~$57/share. He has 6.7 million shares and is the largest individual shareholder at 9.4%. He has a board observer seat.

Valaris: Since the IPO (2021-now)

Valaris stock price increased 4x in 3 years, reaching $80 in July 2024, and lost half since. As the rig market hit the bottom, the drillship day rate increased from ~$200k/day in 2021 to over $500k/day in late 2024.

Valaris’ in-service drillships increased from 5 in 2021 (out of 11) to 8, and its backlog has grown from $1Bn in 2021 to over $4Bn in 2024. Revenue increased from $1.2Bn to $2.3Bn in 2024, and from $135Mn operating loss in 2021, to over $360Mn profit in 2024. By 2024, the industry is in the early stages of a multi-year upcycle, and Valaris’ turnaround story is working.

What has happened since July 2024? Surprisingly, not much other than a few E&P NOC/IOC slowed down and delayed its CapEx offshore drill projects to 2026 or 2027, and the drillship day rate has stayed relatively flat since late 2024 after 2+ years straight up.

4Q24 ER, Valaris CEO Anton Dibowitz

We see a robust pipeline of deepwater project approvals in 2026 and 2027, which are expected to be at their highest level in more than a decade. And more than doubled the project approvals anticipated for 2024 and 2025.

In the nearer-term, offshore CapEx continues to increase. Although the pace of growth slowed in 2024 and this trend is expected to continue in 2025.

4Q24 ER, Transocean CEO Jeremy Thigpen

Everything that we're seeing right now suggests, yes, there is a slight lull in 2025. But our customers are moving forward with these negotiations and these programs that are commencing in late '26 and in '27.

However, the Market reacted as if offshore drilling hit the peak and slated for the downhill again.

Simple yet Crazy Napkin Math

$38/share, 71Mn shares, 0.7Bn net debt ~=$3.4Bn EV.

If we divide $3.4Bn EV by its 13 drillships (12 7G, 1 6G), each is valued at $270Mn, $450k day rate, $164Mn annual revenue, 30% Ebitda margin, and $5Mn D&A gets to $45Mn operating income, 6x EV/EBIT. Modeling $20Mn CapEx gets to 11% FCF Yield.

Considering the high quality of Valaris’ drillship fleet, 6x EV/EBIT and 11% FCF yield is not a demanding valuation. And that gets you 2 semis, 33 Jackups, and 50% ARO JV ownership for free!

Let us use recent Jackup sales data to guesstimate Valaris's Jackup fleet value. During 2022-23, Valaris sold five rigs for $137.8Mn, 19x its net book value of $7.3Mn.

In 2023, Valaris’ Jackups D&A was about ~40% of its entire fleet D&A, thus I model its Jackup book value at $400Mn (entire fleet PP&E ~$1Bn). 19x gets to $7.6Bn, which is 2x Valaris’ enterprise value.

If that’s not cheap enough, we still get 2 semi-subs and 50% ARO (which we will cover later).

Bears would say who cares about buying at a fraction of build cost and resale value if its assets can’t generate profit? Let us address that.

Keep reading with a 7-day free trial

Subscribe to Under The Hood to keep reading this post and get 7 days of free access to the full post archives.