A 5x Ebitda PLAY with Strong Unit Economics

cheap, insider-buy, cannibal and possible short-squeeze

Intro

A prominent dining & entertainment banner for families (and adults), having over 200 locations in the US. Armed with strong unit economics, its new store opening sports >30% cash-on-cash return on average.

Today, facing a macro headwind and customer belt-tightening, it endured six consecutive Same Store Sales declines. Off 46% YTD, a sacked CEO, while the street sees blood, I present an intriguing opportunity:

<5x Ev/Ebitda (LTM), historically in the 6-10x range

Multiple high-signal insiders buy since disastrous 3Q24 ER

A cannibal (reduced 40% shares since IPO) and just approved a $100Mn buyback

A potential short-squeeze setup

That enters Dave & Buster’s PLAY 0.00%↑

Setup

At $26/share, 39Mn outstanding shares, $1Bn market cap, 1.4Bn net debt, 504Mn LTM Ebitda, it trades at 4.75x Ev/Ebitda.

Off 46% YTD, off 55% 52WH, lost >20% since 3Q24ER while SPY and IWM are up 28% and 16% YTD.

Poor stock performance wasn’t for no reason. 3Q24 recorded its 6th consecutive same-store sales (SSS) decline, shrinking EBITDA margin (15.1% vs 17.5% 3Q23), a $32.7Mn net loss (the largest one since 2021), and the CEO departure1.

I will discuss four thesis bullet points (above) to present the interesting setup. I will then discuss its recent disappointing results and unit economics, tell its stories, and explain why a healthy dose of hope is justified despite overwhelming negativities.

If you have never been to a Dave & Buster’s, this YT video offers a good orientation (Binghamton Store July 2024): t.ly/Qrlm4

Thesis Bullet Points

1. <5X Ev/Ebitda

In either historical or peer valuation, 5x Ev/Ebitda is cheap.

Historically, if we remove COVID period noise, D&B’s Ev/Ebitda multiple ranged between 6x to 10x. Today, it is 4.75x Ev/Ebitda.

Some past relevant transactions trade between 6.25x and 7.7x, and peers are valued at 9x-15x today:

Wellspring took D&B private in 2005 for $375Mn (LTM Rev 390Mn, Ebitda 60Mn2), valuing at 6.25x Ev/Ebitda.

Oak Hill Capital bought D&B from Wellspring in 2010 (LTM Rev $570Mn, Ebitda $75Mn), valuing at 7.5x Ev/Ebitda.

Apollo took CEC (Chuck E. Cheese's parent company) private in a $1.3Bn buyout in 2014. (LTM revenue 821Mn, Ebitda $168Mn3), valuing at 7.7x Ev/Ebitda

Its closest peers Topgolf MODG 0.00%↑ trades at 9x Ev/Ebitda (LTM) and Bowelro LUCK 0.00%↑ at 15x Ev/Ebitda (LTM) today.

2. High-Signal Insiders Buy

Insiders' buy is often full of noise. One of my noise filters is Insider Buyback: sold first, followed by buyback, an indicator that insiders are valuation sensitive, and buy intent often signals cheap valuation.

That’s what I find in D&B. Interim CEO (Sheehan) and a director (Griffith) sold shares in April 2024 at ~$65/share and bought back at the $25-27 range a few days ago.

3. Buyback Cannibals

Since its IPO in 2014, D&B has deployed over $1Bn and bought back 40% of its outstanding shares (24.7Mn, current outstanding 39Mn). YTD, it bought back 2.1Mn shares, spending a total of $90Mn (avg cost $42.8/share). It announced4 another $100Mn repurchase this week.

4. A Potential Short Squeeze Setup

Of 39 Mn outstanding shares, 51% (*) institutional ownership leaves true float at 19 Mn shares.

6Mn share short interest (reported5 as of 11/29/24) is about 30% true float. The latest $100Mn buyback program equates to ~3.5Mn shares (at $26/share), another 18% true float, there isn’t much room for borrowing. Note that its daily average trading volume is ~1Mn shares.

(*) Among 51% institutional ownership, Hill Path Capital owns 17.5% (since its initial position in 2019), and Eminence Capital owns 9.4% (increased its stake from 7.9% in Sep 2024) and pitched D&B in the Robinhood investor conference in Oct6. BlackRock and Vanguard own 24% via their index funds. All executives and directors own <2%.

Hill Path built its initial position in 2019 and added gradually till 2022. It is run by ex-Apolloer, involved in a few entertainment companies and sat on the board in related businesses such as Great Wolf Resorts (indoor water parks) and CEC Entertainment (parent of Chuck E Cheese). Hill Path has a board seat in D&B.

Midway Recap

D&B <5x Ev/Ebitda is cheap; recent high-signal insider buys ($1.5Mn) confirmed that. In addition, strong institutional ownership (50%+), low true float, high short interest, and buyback posture make short squeeze possible.

If you agree this is quite a bullish setup, the next question is why it lost half of its market cap and how bad the fundamentals are (with 6 consecutive SSS declines and a sacked CEO).

Same Store Sales (SSS)

Starting with D&B’s six consecutive SSS declines (from -5% to -8%) since 1Q23.

If there is any consolation, D&B is not alone. Topgolf, a peer in indoor entertainment, experienced a similar SSS decline in recent quarters.

We are in an economic cycle where low-middle-income households face the most pressure, and discretionary spending (such as entertainment) is the first item to be cut. We have observed similar data from stores like Dollar Tree and Five Below.

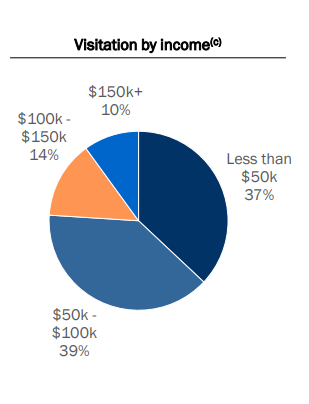

74% of D&B customers make <$100k, and half make <$50k.

Keep reading with a 7-day free trial

Subscribe to Under The Hood to keep reading this post and get 7 days of free access to the full post archives.