All $ figures are in USD unless otherwise noted. Information purpose only, not investment advice.

Why Gold Miner?

Q: “Aren’t most junior gold miners doomed to fail”?

A: True.

Q: Then why shall I take the time to read this?

A: Let me take a step back. My 20Y+ of investment in Gold Mining companies yields a rewarding return, from the mid-2000s’ Zijin (紫金矿业 2899.HK), 2018s Kirkland Lake Gold (TSX:KL), to early 2020’s Karora Resources (TSX:KKR).

Kirkland and Karora ended with mergers (Kirkland with Agnico Eagle in Y22, Karora with Westgold in Y24), both ~3x return in ~4 years, and Zijin became an outsized (~10x) winner. I still own a portion of the holdings bought 20 years ago.

In addition to luck, I found an edge over the years.

You often meet 2 types of analysts/investors in gold mining, geologists or accountants, ones either obsessed with technical study/drilling results, or financial reports/debt structure, etc, but few are immersed with both.

Combined is an edge to find mining winners, companies with quality assets, actionable plans, strong financial backing, led by an experienced team, and fairly valued.

That enters Aris Mining ARMN 0.00%↑ (and TSX:ARIS)

Elevator Pitch

A junior gold miner with cash-generating assets and a well-funded growth plan is mispriced. Even if it doubles in 2 years (my price target), it would trade at a 40% discount to its peers.

Aris Mining

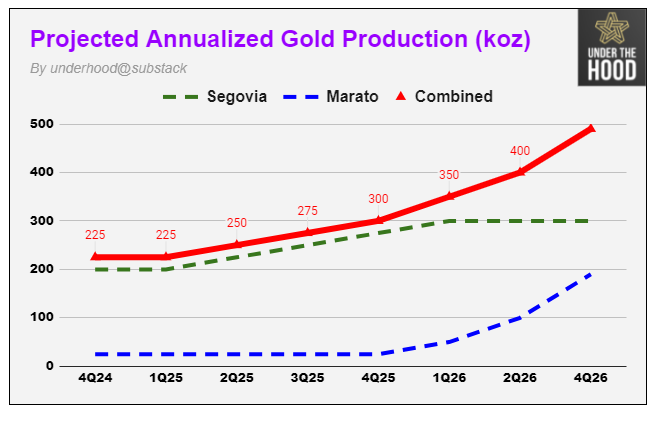

A US/Canada duly listed junior* miner with 2 operating mines in Colombia (Segovia, Marmato) and 2 dev projects (51% interest in Soto Norte in Colombia, and Toroparu in Guyana). It produced ~200koz of gold in 2023, targeting 500koz by 2026.

* Gold Miner tiers by annual output: junior: sub-300koz, mid: 300koz-1moz, major: >1moz.

At $4.4/share, it is just under $1Bn MktCap today (208Mn diluted shares). $80Mn net debt ($120Mn cash, $150Mn warrants proceeds if exercised, and $350Mn debts). Thus ~$1.1Bn Enterprise Value ($1Bn + $80Mn).

Let us dive into 4 key elements of a successful junior mining co: team, assets, financials and valuations

An experienced team

Quality assets with an actionable plan

Strong financial backing

Fairly valued

The star-studded Team

Aris, in Celtic, means again. It comes from the founders’ intent to do it again, according to CEO Neil Woodyer.

Neil Woodyer was founder/CEO of Endeavour Mining and Leagold Mining, the former is one of the largest miners globally, and the latter was merged with Equinox ( EQX 0.00%↑ ) in a C$750Mn deal in 2020. BoD/advisors have many mining heavyweights, including:

Ian Telfer, Board Chair. Former Goldcorp chairman, and former World Gold Council chair.

David Garofalo, Board Member. Former CEO of Goldcorp, former CFO of Agnico Eagle (AEM)

Frank Giustra, strategic advisor to BoD. A well-known mining financier.

Frank Giustra is the largest individual shareholder (8%). He is the behind-the-scenes guy assembling the Aris team. He is known for his ultra-long bullish view of gold, extreme patience, and iron-cast stomach. This joint interview with Neil Woodyer in 2023 shed light on his traits.

The 2-Year Plan

Aris has 2 operating mines (Segovia, and Marmato) and produces 200-225 koz of gold annually. It is expanding both and target 500 koz by 2026.

Junior (and mid-tier) miners often have aggressive growth plans on paper but fail to deliver in reality as they encounter high geology/mining risks, lack of funding, and uncertainty in local support and infrastructure, e.g. road, water, and electricity.

Aris’ plan derisked almost all of them. Both expansions are existing operating mines, fully funded and permitted with strong local support.

Neil Woodyer in 2Q24 cc said:

Both projects remain on track and we continue to expect to achieve an annual gold production rate of approximately 500koz in the second half of 2026.

The chart below shows projected annualized gold production in the next 2Y.

The Financials (to Support the Growth Plan)

Few junior miners have the luxury of what Aris has: a profitable operating mine to support growth plans. That is Segovia, and it produces 200 koz of gold, generating ~$70Mn free cash flow annually.

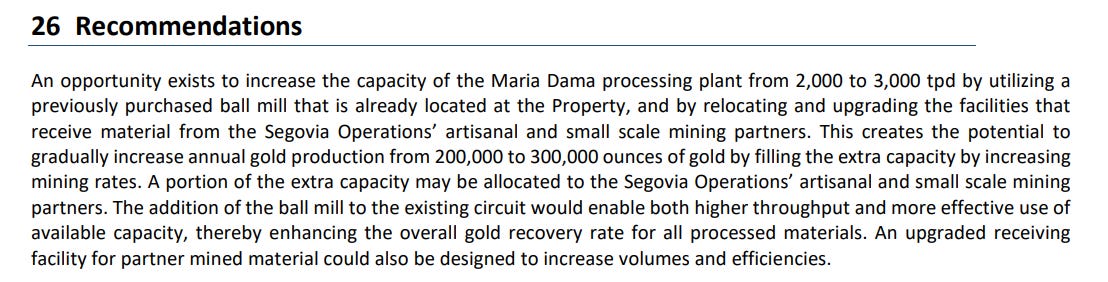

Segovia’s expansion plan to increase processing capacity by 50% requires a mere $15Mn in facility upgrades (repositioning an existing ball mill), as we find in its 2023 Technical Study.

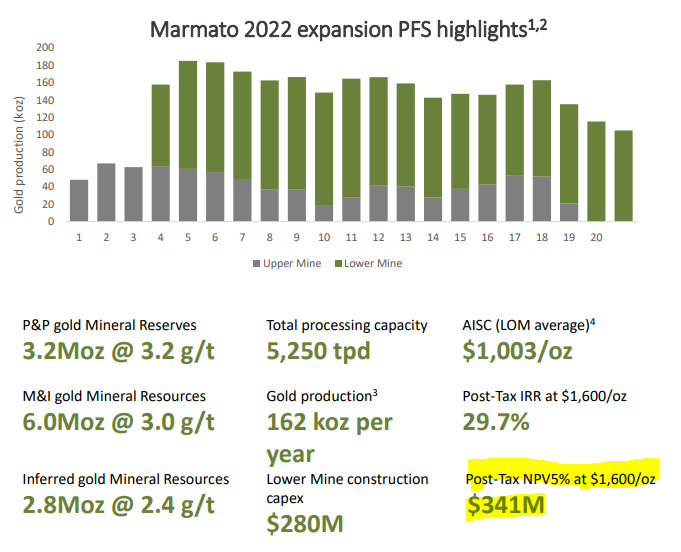

Marmato’s lower miner plan requires $280Mn CapEx. It spent $75Mn as of 2Q24 ($40Mn in Y23, $15Mn 1Q24, ~$20Mn 2Q24). For the remaining $205Mn, it secured $122Mn financing from WPM (Wheaton), thus only requiring $83Mn additional funding, a digestible amount given Segovia’s ~$70Mn FCF each year.

Unlike most juniors, Aris secured its growth financing needs from the get-go.

The Valuation

Quickly recap the basics, at $4.4/share, 208 total shares (including 38Mn warrants), $1Bn MktCap. 38Mn warrants(avg exercise price $4) will bring $150Mn proceeds (if exercised). Cash $120Mn, $350 debts (6.875% $300Mn notes, and 7.5% $50Mn Gold Linked Notes), net debts 80Mn. Enterprise Value $1.1Bn.

As discussed earlier, Marmato expansion needs an additional $85Mn, and Segovia needs $15Mn. Thus Aris’ adjusted Enterprise Value is $1.2Bn (covers both expansion projects)

1. Sum-of-the-Parts Valuation: 4 Mining Assets

I use NPV to value 2 operating mines - Segovia and Mamarto, and use acqusition cost to value Soto Norte and Toroparu. It adds up to a value of $2.1Bn, currently trading at 0.6x of that (EV = $1.2Bn)

This considers expansion plans for Segovia and Marmato (thus fairly valued) but leaves out Soto Norte and Toroparu’s development potential.

Let us examine.

The latest investor slide had Marmato’s NPV at $341Mn, based on a $1600/oz gold price, despite gold at $2600/oz+ today.

I built a model (left) based on Marmato’s projected output to fit its $341Mn NPV calculation and used the same parameters to calculate its NPV(right) at a gold price of $2500/oz. The result is ~$1Bn. Marmato’s NPV ($2500/oz gold price) alone matches Aris Mining’s market cap today.

The left table shows the NPV calculation assuming Gold at $1600/oz, AISC1 at $1003/oz, 5% discount rate, and 55.5% AISC profit margin conversion to FCF (free cash flow). I use Discount Cash Flow (DCF) for NPV calculation.

The right table assumes the gold price at $2500/oz, AISC increases from 1k/oz to 1.3k/oz (add $100/oz royalty (9.6% of sales) and $200/oz buffer for cash cost inflation, its NPV is ~1Bn (1.25Bn if excluding initial CapEx).

I model Segovia’s NPV at $630Mn. Using its revised gold output at 300koz/year (starting from 2025), $105 FCF/year, 5% discount rate, and 7Y mine life. 7 year, 300koz/year gets to 2.1moz total output. Given its 1.3moz reserve, 3.6moz M&I resources, and its past track record of successfully converting M&I resources to reserve, I feel comfortable (and conservative) with the 7Y mine life projection. Mgt indicated updating the Segovia reserve/resource estimates in 4Q24, I expect an estimate raise.

Soto Norte: 200Mn. I use acqusition cost ($100Mn for initial 20% interest. $100Mn for 31% interest, with Mubadala becoming ~9.3% Aris Mining shareholder). Noted its 1st 10% was acquired in Mar 2022 (Gold ~1.9k/oz), and 31% was acquired in May 2024 (Gold: 2.4k/oz). Today’s gold price is 40% and 10% higher.

Toroparu: $250Mn. I use acqusition cost (GCM acquired Gold X in an all-share deal valued at $250Mn, and GCM merged into Aris in 2022).

Let me highlight that Soto Norte, for which I used a $200Mn acqusition cost in NPV, has as much potential as Segovia and Marmato combined. I will discuss that later.

Keep reading with a 7-day free trial

Subscribe to Under The Hood to keep reading this post and get 7 days of free access to the full post archives.