A not-so-late Bull Case for Burford Capital

$16Bn court win, 20% ROE, the largest Litigation firm nobody loves

Background

Burford Capital BUR 0.00%↑ , the world’s largest litigation finance firm, started in 2009 with a ~$100Mn portfolio. It grew to over $5.5Bn, including ~$3.4Bn from its balance sheet and the rest from third-party investments in its Funds.

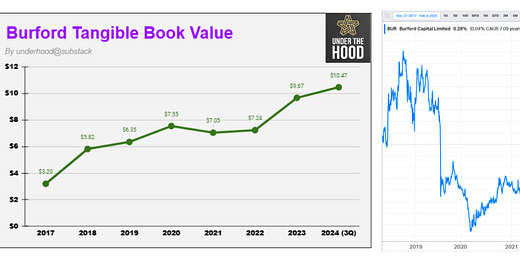

Its TBV (Tangible Book Value) increased from $3.2/share in EoY 2017 to $10.47/share in 3Q24, an impressive 3x and 19% CAGR in 7 years, yet not fully capturing its $16Bn YPF win in 2023 (at the cost of $16Mn).

However, its stock today trades at the same price as EoY 2017. Thus, I’m making a not-so-late Bull Case for Burford.

Summary

I will first briefly discuss Litigation Finance and the Burford business.

Next, I address its often misinterpreted economics and earnings potential. I analyze its performance data over several years, employing my KPIs (in addition to IRR/ROIC) to interpret its actual earning capacity.

I apply an uncommon valuation method, clarifying its rationale and indicating over 100% upside potential.

I then explain why the opportunity exists. I conclude the research by double-clicking YPF, its crown jewel asset, the current court developments, and how the market misinterpreted Argentina’s delaying tactics and overlooked the DoJ’s potential position change from Biden to the Trump administration.

Burford and Litigation Finance

In Litigation Finance, the plaintiff seeks legal action through a 3rd party funder, who pays upfront costs and gets rewards if the case is won, receiving nothing if lost (unless recourse terms apply). While litigation finance started to help minor claimants access justice, it gradually evolved into a vehicle for large corporations to de-risk litigation exposure, thus, a much larger TAM (Total Address Market).

Burford Capital is the world’s largest litigation finance firm. It was founded and listed in the London AIM market in 2009 and dually listed in NYSE in 2024. It became a US domestic issuer after US ownership exceeded 50% in Jan 2025. At $14.5/share, 222Mn outstanding shares, $1.8Bn net debt, Burford has a market cap of $3.2Bn and EV of ~$5Bn.

With a portfolio value of over $5Bn, Burford has over 200 active claims with an average size of $25Mn. Each year, Burford receives ~1.5k inbound inquiries, ~20% of which undergo in-house diligence, half of which are reviewed by a commitment committee, and ~5% are funded.

Once a case is committed, it will either be settled or tried with adjudication (win/loss). Almost 3/4 of the cases are settled, and 1/4 go to trial, with roughly two wins for every loss. On average, a claim takes 2 to 2.5 years to conclude. The diagram below shows its cumulative profits since inception (82% ROIC and 27% IRR) and profit and loss distribution.

Burford’s recovery team assists a case when a case is final and judgment becomes enforceable.

At Burford’s scale, the quality of its process ultimately drives the long-term return. I will revisit this point in a later section.

So, the largest funder in the world has unparalleled scale and superior unit economics. Its tangible book value has grown at ~ a 20% CAGR over the last seven years, yet its stock price today is the same as seven years ago. What is the market missing, and why? Before I get to that, I want to discuss its economics, as the market does not understand it well.

Economics and Earning Power

Evaluating Burford’s earning capacity requires examining its multi-year records, as its revenue and earnings depend on unpredictable legal processes and events that extend over several years.

Burford considers IRR and ROIC important KPIs and releases them quarterly. The table below shows both since 2014, with an average ROIC of high 80% and an IRR of high 20%.

IRR and ROIC have been cumulative since inception (thus removing QoQ choppiness). They include fully/partially concluded assets and are gross numbers excluding OpEx.

Cumulative ROIC/IRR offers a clear view of asset quality over time, yet it does not reveal its earning potential. Let me introduce the KPIs I use to track its earning power.

Investment Income / Burford-only Portfolio Value (aka Gross ROA) captures the return on assets and excludes third-party interests. The chart below shows that it varies, with an average of 20.5% since 2015.

I group expenses into regular OpEx (staffing+G&A) and performance-based incentives.

Regular OpEx / Total Portfolio Value: Use total portfolio as Burford doesn’t consistently break down OpEx by Burford-only or 3rd party related expenses. This ratio is consistent at ~2% over the years (excluding 2015)

Incentive / Investment Income: varied, an average of 15%. (from 2020)

With these 3 data, I calculate its true earnings:

True Earning on Asset = (Gross ROA - OpEx) * (1 - performance incentive%)

as Gross ROA 20.5%, OpEx 2%, Incentive 15%, we get to (20.5% - 2%)*(1-15%) = 16%

I apply a 10% discount to consider utilization loss (for ideal cash) and its marginal tax obligation (due to tax-optimized corporate structure), which gets to a normalized ~14% Earning on Assets (after OpEx + incentive)

Burford sets the maximum debt/equity leverage guideline at 1.25x, currently at ~0.7x. For the modeling purpose, I set a 1x leverage ratio, 8% cost of capital, and its debt portion of the assets has a net return of 6% (14%-8%). Thus total ROE 20% (14% + 6%).

That, by and large, matches its 21% CAGR TBV growth since 2015.

In other words, investing in Burford is similar to investing in a fund that pays a 2% management fee and a 15% performance fee. That fund has ~ a 14% normalized earning power on assets and, after all expenses and costs, achieves a 20% ROE through 1x leverage.

Valuation

How much is 20% ROE financial business worth?

An appropriate valuation ratio, often used for banks, is PTBV/ROE (Price to Tangible Book Value divided by Return on Equity). Most banks trade between 10x to 20x ranges. Some top US banks trade at 14-16x PTBV/ROE today. As a reference point, Berkshire trades at 14x PTBV/ROE (10.9% avg ROE since 2016, trades at 1.5x P/TBV today).

Burford trades at 7x PTBV/ROE today. If valued in line with US major banks (~15x PTBV/ROE), Burford would be worth ~$31.5/share (15* 0.2*10.5 = 31.5, as $10.5 TBV, 20% ROE, 15x PTBV/ROE), 115% higher than today’s $14.5/share.

Why PTBV/ROE?: When a business shows steady asset earning power over an extended period and a relatively stable leverage ratio and cost of funding (compared to the market), then PTBV/ROE is a reasonable valuation benchmark. Most mature banks fit the criteria, and to a large degree, Burford does, too.

Even better, Burford has a few distinct advantages. First, its litigation assets, while volatile, are not as cyclical as banking assets. Second, banks’ return on assets is usually in the 1-3% range, and they achieve double digital ROE through high leverage, sometimes up to 10x v.s. Burford’s 1x. Higher leverage carries higher risk, and risk demands a valuation discount. Thus, using major banks' PTBV/ROE ratio as a benchmark to value Burford is quite conservative.

If you concur with this valuation method, I will tackle a few questions: Is Burford’s TBV trustworthy? Can it uphold its high profitability? Can it persist in reinvesting its earnings to grow business?

Is Burford TBV (Tangible Book Value) Trustworthy?

Muddy Water’s 2019 short attack1 on Burford centered on the claim of "inflating fair value on winning cases and postponing write-offs for losing cases."

Although none of the allegations held, as I followed the case and Burford’s response2, I found each claim distinctive and nuanced. Thus, Burford is an easy target to cast doubt on, especially as it is bound to claim confidentiality. Burford's ability to withstand that attack—despite experiencing a 60% drop in just one day—demonstrates the strength of its fair value practices.

Burford offers adequate transparency about its underlying assets. It discloses each asset's commitment, deployed capital, and Fair Value adjustments twice a year. Adjustments to fair value are made only when a predetermined qualified event occurs.

In monitoring the historical data of many claims (using their Claim IDs), I've noticed that Burford typically adopts a conservative approach, especially for cases expected to succeed. Fair values are adjusted gradually as a case progresses to a conclusion. We will explore further with YPF case in a subsequent section.

Can it uphold high profitability?

It's a valid question since the cumulative IRR fell from 30-31% between 2019 and 2020 to 25-26% in 2024. This brings us to the impact of COVID-19. Many courts faced extensive shutdowns and decreased activity. Although most courts returned to full operations in 2022, the long claim cycle (averaging 2.5 years) means COVID's impact lingers, which has a detrimental effect on IRR. Nevertheless, since late 2024, we have noticed IRR stabilization as we begin to recover from the impact of COVID-19.

Can Burford reinvest its earnings to grow its business?

Corporate litigation finance is still a new and rapidly growing business. Burford has ~$5.3Bn in AUM (on a consolidated basis). Total litigation funding in the US was $2.7Bn in 2023 and is expected to grow at a 9-10% CAGR annually until 2032.

US corporate legal expense is ~$400-500Bn a year; I guestimate $100Bn to $125Bn litigation expense, based on roughly 25% of lawyers being litigation lawyers (according to the American Bar Association). Therefore, the top 10 litigation funders combined have only a 2~3% litigation financing market share, with a long growth runway.

Midway Recap

Burford, as the most prominent litigation funder globally, has a significant scale and is positioned to capitalize on the growing litigation financing market with an extended expansion potential. It is valued at <50% compared to major banks based on PTBV/ROE, despite its advantages that should demand a higher valuation.

Why does this opportunity exist?

Why Opportunity Exists

Litigation Funders are no natural fit for the public market: Most legal claims (assets) have confidential agreements. Thus, shareholders can’t independently assess each claim’s fair value. Each claim has long investment cycles, and results are unpredictable. Litigation funders are an odd fit to the market where investors measure quarterly earnings beat or miss by cents.

Let us get to some Burford-specific ones:

Keep reading with a 7-day free trial

Subscribe to Under The Hood to keep reading this post and get 7 days of free access to the full post archives.