Aris Mining Revisited

valuation, projects, 3Q25 ER tonight

Information purpose only, not investment advice.

Background

Aris Mining ARMN 0.00%↑ , a junior gold miner in Colombia, is an “Under the Hood” (UTH) core position, acquired between Oct and Dec 2024, averaging ~ $4 /share.

My initial write-up in Oct 2024 ($4.4/share), and I doubled down at ~$3.5/share in Dec 2024, explaining (below) that the negative news was more than priced in.

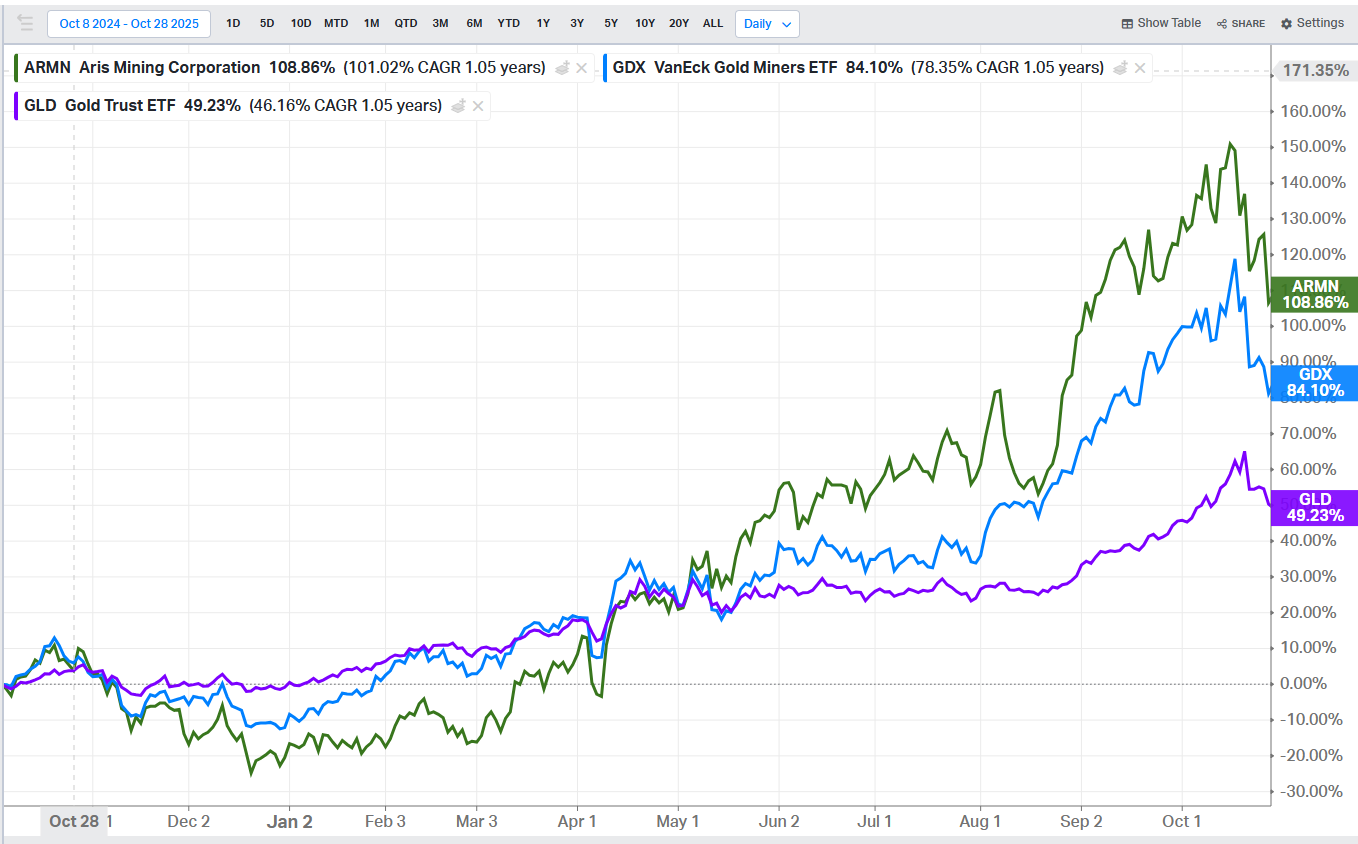

It closed at $9.19/share yesterday (10/28), up 109% since the initial coverage. It briefly reached an ATH of $11/share in early Oct and has since retreated ~20%. Gold is up ~50%, and GDX (benchmark) is up 84% during the same period.

Initially dubbed as “so mispriced even if it doubles in 2 years, still trade at 40% discount to its peers.” This is a thesis revisit since it doubled. (Gold up 50% in a year wasn’t on the initial thesis bingo card, to be fair)

Outline

3Q25 ER will be out on 10/29 after hour (today). Aris released preliminary results 2 weeks ago, so no big surprises are expected. Today I will discuss:

Key project progress and how it aligns with last year's commitments.

A game-changer in the cash balance

Valuation Revisit with two changes:

Gold price (now modeling $3k/oz as gold is at $4k/oz; Model used $1.5k/oz when gold was $2.5k/oz in Oct 2024)

Valuing Soto Norte using NPV to replace acqusition cost

What I’m watching for 3Q25 ER tonight

Projects Revisit

I often compare what management promised with their actual results. That constant reality check is essential in the mining industry.

A year ago, in 2Q24, there were two growth projects:

Segovia’s $15Mn CapEx will increase processing capacity by 50%, and ramp-up will be completed by the end of 2025.

Marmato’s $280Mn CapEx lower-mine project aims for its first gold pour in the first half of 2026 and a one-year ramp-up to ~160Koz of annual production.

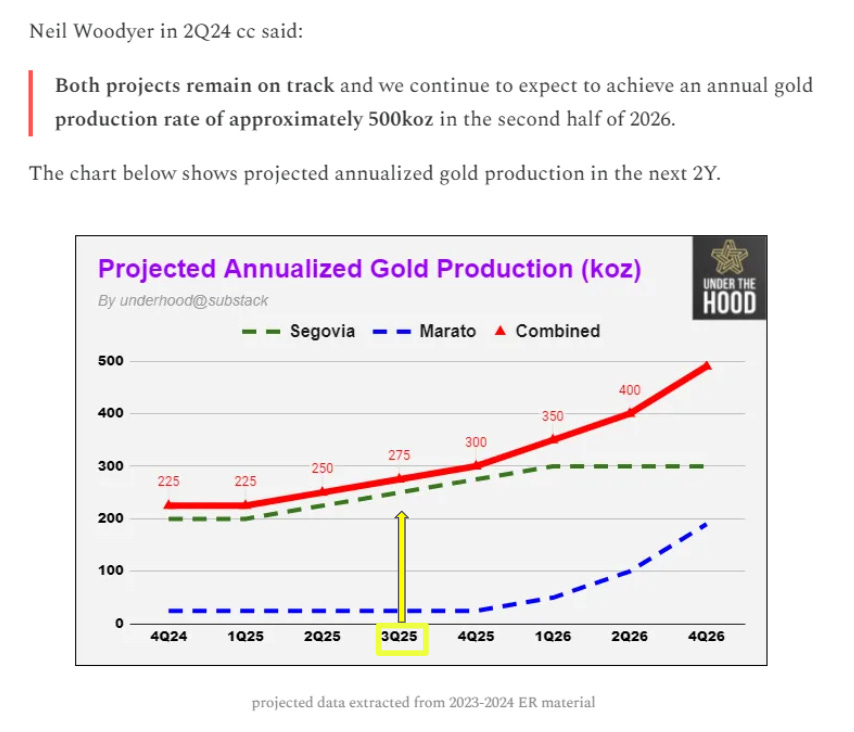

The chart below, from my initial write-up, shows the projected gold output for 2025-2026.

Aris Mining progresses well on both.

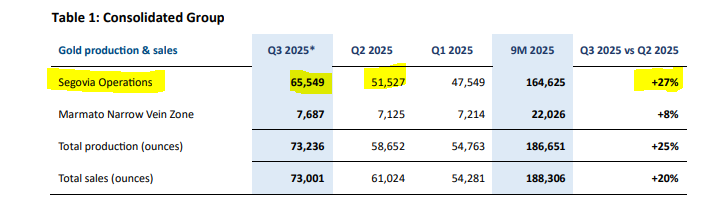

In Segovia, Aris’ 3Q25 preliminary results show 25% QoQ growth in gold production to 73Koz, with almost all growth coming from Segovia since its facility upgrade (from 2k to 3k tpd) was completed in June 2025.

73Koz gold production in 3Q25 gets to annaulized rate of 290Koz, slightly above the projected 275Koz (chart above). At the current ramp-up rate, I project that Sergovia will reach a 300Koz run rate by the end of 4Q25.

In Marmato, its lower-mine project CapEx reached $140Mn in 2Q25, accounting for 50% of the total CapEx, with no change to the overall budget or projected gold production profile.

The one noticeable change is that its first gold pour is now estimated for 2H 2026 (vs. the initially targeted 1H26), about a 6-month delay.

Find Strength in the Cash Balance

In its 3Q25 preliminary results, it has a cash balance of $415Mn, a significant increase from $310Mn in 2Q25. Let us discuss it.

In 3Q25, Aris received $13Mn from Joby project sales, estimated ~$40Mn from remaining warrant conversions, and estimated $25Mn in CapEx (mostly for Maramto). That translates to ~$77Mn in operating cash flow.

$105Mn (cash increase) - 13Mn (Joby) - 40Mn (warrant) + $25Mn (CapEx) = $77Mn

With 3Q25’s 73Koz gold output, that’s over $1000 cash flow/Oz! With Segovia’s 300koz annual gold production run rate in 2026, it can generate ~$300Mn OCF a year, assuming Gold remains at the 3Q25 level (which is 15% below today’s gold price).

At $300Mn OCF/year, not only will the remaining $140Mn Marmato CapEx be completely self-funded with 2 quarters Segovia earnings, but by the time Sorto Note’s project is permit-ready for construction (2026-2027), Aris’ cash balance will be sufficient to fund more than half of the project CapEx (estimated $650Mn).

That is a game-changer for Aris Mining, enabling it to transition from a junior to a senior miner, as its self-funding capability will significantly reduce both project and equity dilution risk.

Keep reading with a 7-day free trial

Subscribe to Under The Hood to keep reading this post and get 7 days of free access to the full post archives.