1st 1k and 1 Year of UTH

investment process, deliverables, and what's ahead

I launched “Under the Hood” (UTH) over a year ago and celebrated the 1000th subscriber milestone this month. I soft-launched a paid tier at EoY 2024 and received strong support from the community. I formally present the offerings today and look forward to more members joining.

As a paid subscriber ($100/year), you shall expect:

8-15 writeups a year, full access to past reports, and my best efforts to address your questions about the writeups.

Portfolio company updates (earnings, mgt interviews, thesis/position updates). Please join Substack Chat for the updates and/or follow me @siyul on X.

Occasionally post-mortem (lessons learned, what went wrong, etc.)

Before I delve into the details, let me take a step back to discuss my investment process that supports the above.

Process

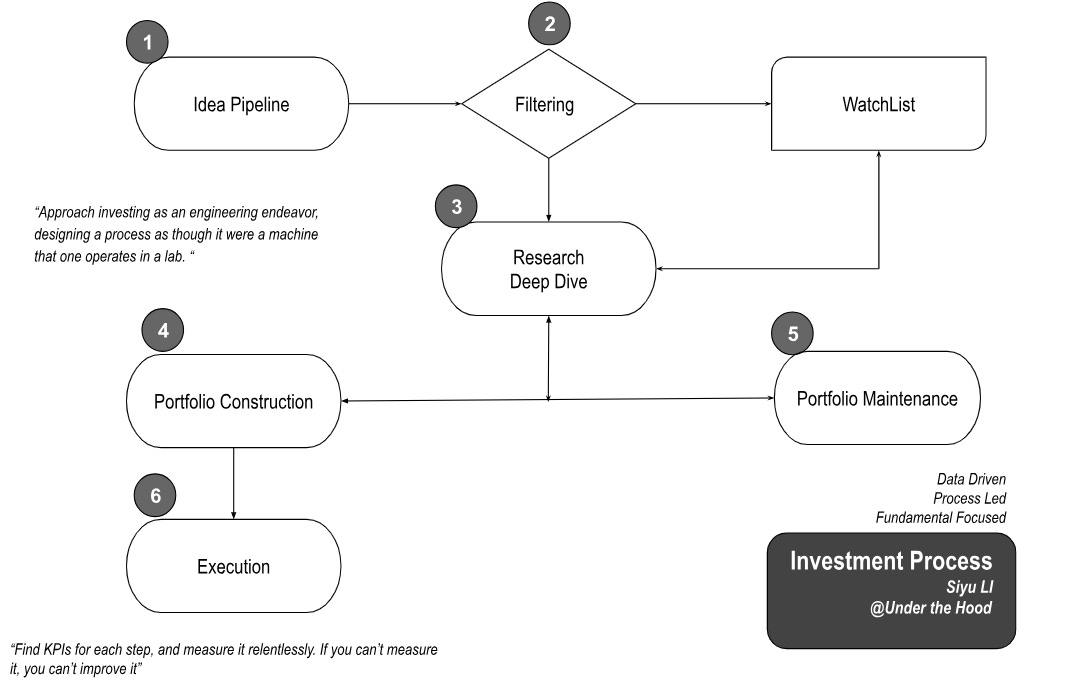

I believe Process Drives Results. I approach investing as an engineering endeavor, designing a process as though it were a machine that one operates in a lab.

Here is a conceptual diagram outlining it.

Let us start with Steps 1 to 3. I generate ideas from various pipelines (substack, VIC, funds/industry reports, and brain trust peers). The pipelines, on average, flow 25-35 ideas a month. It goes through a filtering process to quickly (~1/2 hour each) veto 50%+, then a shallow dive (<1/2 days each) to select 1 (or 2) a month for a research deep dive.

Step 4 is Portfolio Construction. My portfolio has 2 buckets: "Core” and "Opportunity.” The Core has my high-conviction picks, ~12 members, ~70% of my total portfolio weight (+/-10%). Core members are 4-5% position size on a cost basis. The Opportunity bucket has ~20 members, averaging 1-1.5% position size.

The purposes of 2-tier portfolio construction are:

4-5% Core position size at cost makes a big win meaningful enough, while a big loss is tolerable. It helps me sleep well at night and think critically when drastic events occur without panic. The last point is crucial: your position sizing strategy must match your ability to handle stress gracefully.

The “Opportunity” position allows me to swing for the fence on low-conviction but high-risk, high-reward ideas. It also serves as a preparation for the Core bucket.

Returning to Step 3, the Deep Dive is a prerequisite for an idea to join the Core Portfolio. It may not always succeed, highlighting the true value of a deep dive when a company fails the investment criteria. After a deep dive, a compelling idea can quickly become a Core member, though often starting as an Opportunity member.

Step 5 is Routine Maintenance, which includes ER reviews, industry conferences, and key event monitoring.

Step 6 is Execution, the actual stock buy and sell, sometimes adding option strategies to amplify or reflect a more nuanced bet.

Now, back to the offerings. For 8-15 writeups a year, they usually fall into three categories:

Quality Assets, Distressed Price

Growth Story, Fairly Valued

Special Situation (M&A Arbs e.g., Spirit Airline, rights offering, e.g., Sifty)

Some recent write-ups to get an idea:

Category I (Valaris, Golar LNG), and Category II (Aris Mining), all 3 are current Core portfolio members.

Special situation: SIFY rights offering, 90% return in 2.5 months, closed in Sep 2024.

Pricing

You get 8-15 deep-dive ideas yearly, regular updates (please Join Substack Chat), and occasional general investment essays for $100/year or $10/month.

Since I value long-term thinking and prefer readers to evaluate my work based on annual output, I will keep the annual subscription at $100 in 1H2025 while adjusting the monthly (from April to $12) to gradually reflect deeper discounts for annual subscriptions.

Beyond the tangible outputs, you will also benefit from the underlying investment process. I’m committed to continuously improving this process, and your engagement and feedback are essential. I believe continuous improvements will be reflected in the quality of my research work and other updates.

An audacious goal: I aim to be the Costco of the Substack newsletters: Quality Products at a Compelling Value.

What I Don’t Offer

Before signing up, I want to clarify what “Under the Hood” isn’t about.

You will not find “100x in 10 Years” ideas here.

I love 100x baggers, but that’s not my forte, and my picks (except some spec sit) generally aimed for “2-3x in 2-4 years”.

You won’t hear wisdom like, “The key to achieving 10x is not to sell at 2x, 3x, 5x, or 8x.”

I compile facts and data from filing (10k, 10Q, etc.), mgt commentaries, industry trends, what its peers say/do, and recent insiders’ actions. You won’t hear headlines or empty sugar drinks; you get under-the-hood insights all assembled in one place.

Thank you all for your support throughout this journey, and I look forward to seeing you over the paywall.

Siyu at Under the Hood

p.s. If you enjoy my work, I would greatly appreciate it if you could share “Under the Hood” with others.