Portfolio Updates and a Quick Idea

Golar, Valaris, Seaport, Dollar Tree, Aris Mining, and USAS

Six Portfolio Updates

DLTR 0.00%↑ , GLNG 0.00%↑ , VAL 0.00%↑ , ARMN 0.00%↑ , USAS 0.00%↑ and SEG 0.00%↑

TL; DR:

Adding among weakness in VAL ($30-31) and SEG ($18-20).

Riding the Gold and Silver bull run with 2 mining companies, ARMN and USAS

Unlocked catalysts in DLTR and GLNG contribute to their recent outperformance.

Dollar Tree ($DLTR):

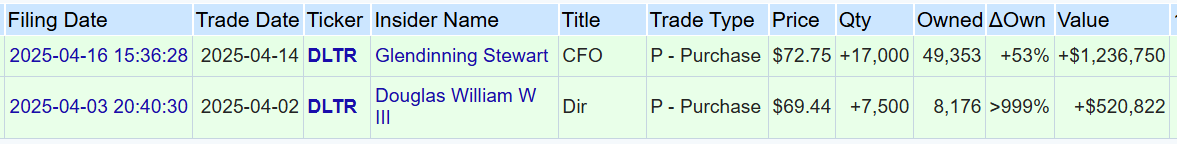

YTD outperformed S&P by 16%, and XRT (S&P Retail ETF) by 21%. Its strong performance was supported by its Family Dollar segment divestiture ($ 1 Bn valuation) in March, and recent sizable insider buys ($ 2Mn) in April.

Divesting FDO is a catalyst to unlock DLTR’s Sum-of-All-Parts potential, as I laid out in my initial write-up. It's good to see its fruition in six months, with $0.8Bn net proceeds and a $0.3Bn tax benefit, far exceeding my conservative $0 valuation.

CFO Steward Glendinning’s purchase is worth noting. He joined Dollar Tree’s strategic review in January 2025 and became CFO in March. His recent transactions ($ 1.2 M at ~$72/share) are open-market purchases with no indication of contractual obligations.

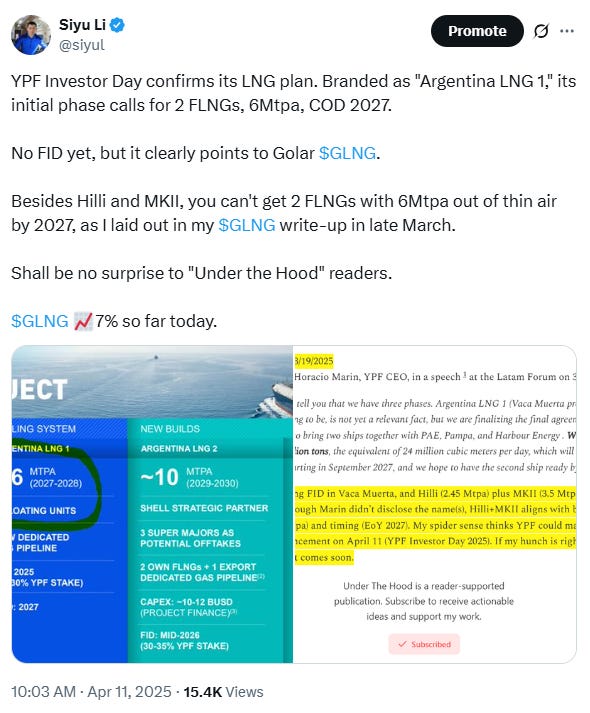

Golar LNG ($GLNG):

YPF's Investor Day on April 11, 2025, confirmed its LNG plan, as I predicted in my updated write-up and discussed on X.

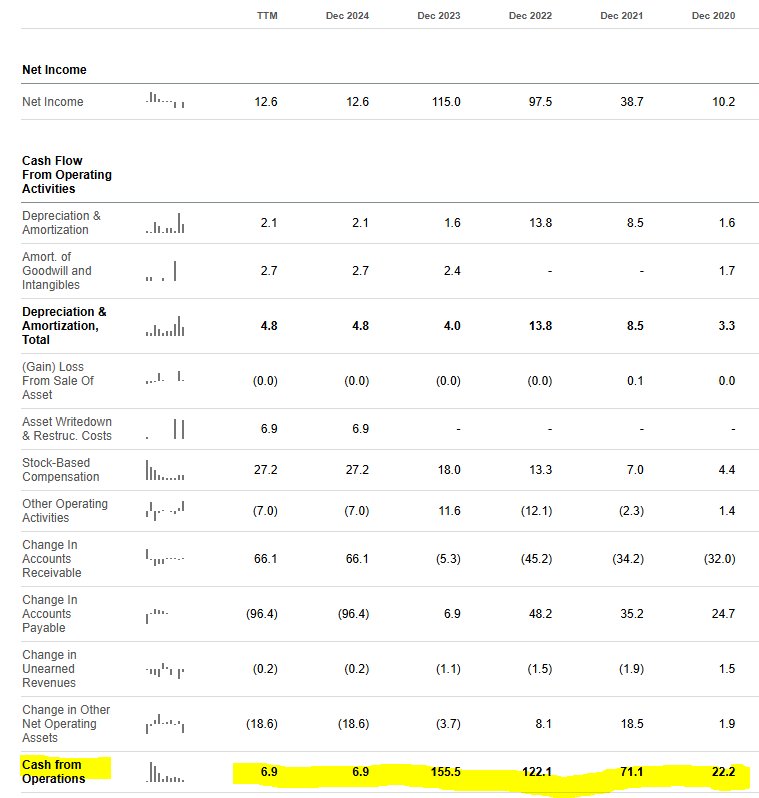

That, together with the news on 4/17 that Gimi completes its first LNG offload, offsets the drop in oil prices in recent weeks. Since I published my write-up on March 16, Golar has been up 12% (compared to the S&P, -6% and XLE, -8%).

The thesis continues to track well. With its robust operating performance and the upcoming YPF contract, it will bring Golar closer to a $1 billion EBITDA annual run rate by 2028. (valued at a 5 Bn EV today).

Valaris ($VAL):

On March 31, Valaris announced that one of its four stacked drillships, DS-10, signed a 2Y new contract at a total value of $ 352 M, starting 2/3Q26, ~ at a day rate ~$450k/day, vs its last contract, which ended in Par 24, at $230k/day. A very positive move. However, that was more than offset by the recent decline in oil prices, and it currently trades at $30-31/share, nearly its 52-week low.

While an offshore slowdown is present, the drillship market's day rate remains steady and is hopeful for a rebound in 2026. However, the current tariff conflict brings uncertainty worth monitoring, as a material global economic slowdown could put offshore projects under pressure.

America Silver and Gold Corp ($USAS), Aris Mining ($ARMN):

As gold reaches an all-time high, and silver nears its 5-year high, both mining companies are standout performers in my portfolio.

Mining exposure checks both “holding hard assets” and “hedging against USD” boxes for me. USAS 0.00%↑ doubled since Paul Huet took charge 6 months ago, and up ~35% since my writeup.

Be cautious that junior mining companies can be volatile, and I've noticed some over-enthusiasm. In other words, if you're not in, curb your enthusiasm, get to know the story now, and be ready to step in when volatility is on your side (I outline my positioning strategy in the article).

Seaport Entertainment Group ($SEG):

At $19/share, 12.7Mn shares, $240Mn market cap, ~$50Mn net cash ($160Mn cash, 100Mn debt, $10Mn preferred), that is $190Mn EV1 for Pier 17, TIN, Fulton Market, 80% fashion show mall air rights, LV Aviator Team, ballpark stadium, 250 Water and more.

Thesis remains unchanged: model as aggressively as you choose, you can hardly justify a $190M EV unless you assume management fails to plug the cash burn and takes the whole thing to pennies for a dollar liquidation, with Ackman as a 40% shareholder.

In 4Q24, its Pier 17 development was encouraging, with leases signed with Meow Wolf, Grupo Gitano, and a 5-year extension agreement with Live Nation. However, its slightly reduced, still high annual burn rate of around $40M at the TIN building and no segment-level P&L reporting breakdown remain my primary tracking focus in the coming quarters.

A Quick Idea

I’m thinking about how to offer more value to my readers.

I currently only publish researched ideas from companies that have passed my investment process and are part of my portfolio.

I’m experimenting with opening up my investment process to share ideas that are in the early stages and not fully vetted. (To learn more about my investment process, read here)

Here we go:

PERI 0.00%↑ Perion Network is an Israel-based ad-tech company with two segments: search ads (partnered with Bing) and display ads. At $ 8.70/share, with a ~$ 400Mn market cap and ~$ 360Mn in net cash, it has an enterprise value of $ 40Mn.

Although its revenue is rapidly declining ($740 million in Y23 to $500 million in Y24), a major reason is that Microsoft removed Perion (and a few other publishers) from its search marketplace, as the current agreement with Perion had ended.

With that impact in mind, Perion’s 2025 outlook projected $400Mn to $420Mn revenue, and a 10% adjusted Ebitda margin, which values the company at 1x 2025 Ev/Ebitda. Note that in its recent news release last week, it announced a better-than-expected 1Q25.

There is a lot of hair in the story, its content quality, and its ad-tech competency to survive in this hyper-competitive environment. But the company isn’t burning cash, and valued at 1x Ev/Ebitda is quite a compelling setup.

Also worth noting, the company recently adopted a poison pill, and a 6% shareholder raised concerns.

Net cash/debt correction on 4/24/2025: revised to net cash $50Mn

Long $VAL